Economics & Finance

Strategy

INSEAD Insights: March 2024 Research Picks

Economics & Finance

Will the Shifting Economic Power Balance Topple Democracy?

Economics & Finance

Key Players in the Indo-Pacific Region

Economics & Finance

Bridging Prosperity and Need

Economics & Finance

When Firms Behave Irrationally

Strategy

Why Some CEOs Are More Likely to Downsize

Economics & Finance

The World Economy in 2024: Are We Back on Track?

Responsibility

The Risks and Rewards of Community-Driven Business Models

Economics & Finance

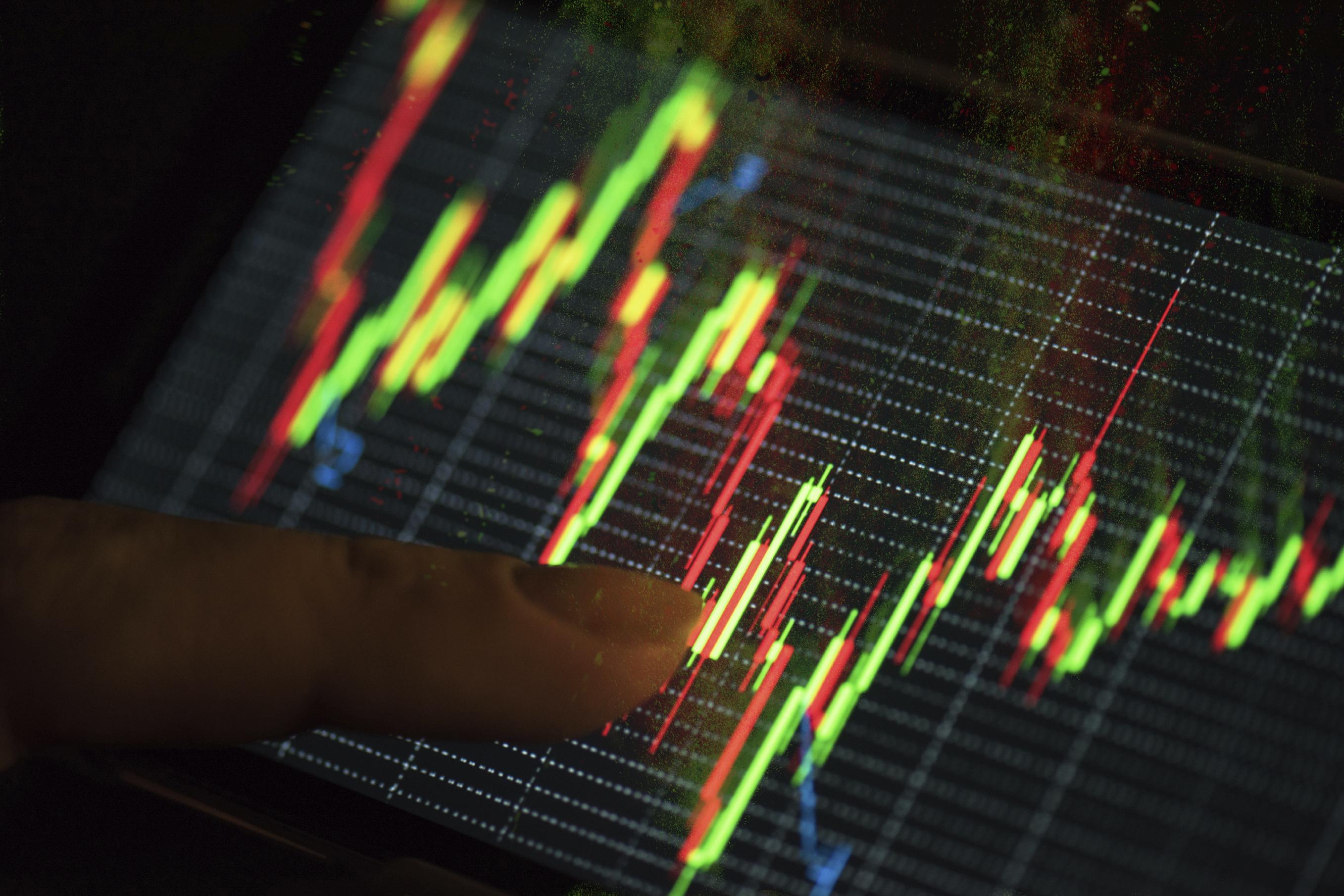

When Information Won’t Reduce Stock Price Volatility Immediately

Economics & Finance

How Web3 and AI Will Transform Finance

Economics & Finance

INSEAD Insights: December 2023 Research Picks

Economics & Finance

Thawing US-China Relations: Competition Meets Interdependence

Career

INSEAD Insights: October 2023 Research Picks

Economics & Finance

China: Caught in the Middle-Income Trap?

Economics & Finance

Pay Attention to the Details

Economics & Finance

Deflation Woes: Can China Avoid Japanification?

Economics & Finance

Covid-19 Furloughs Helped Firms Thrive

Economics & Finance

Managing Systemic Risks in Tech: Lessons from Finance

Economics & Finance

Better Geographic Investing Begins With an Inclusive Index

Economics & Finance

Why Demographics Matters More Than Ever for Businesses

Economics & Finance

US-China Ties: Damage Controlled But Obstacles Ahead

Economics & Finance

The Future of Energy Transition and Climate Finance

Economics & Finance

What Comes After the Fall of Silicon Valley Bank?

Economics & Finance

The Costs of Fuelling Economic Growth

Economics & Finance

Why Did Silicon Valley Bank Collapse?

Economics & Finance

Will ESG Investing Solve Our Pressing Problems?

Economics & Finance

The World Economy in 2023: A Recession Year?

Economics & Finance

China is Back: What Its Reopening Means for the World

Responsibility

Five Global Trends in Business and Society in 2023

Economics & Finance

In the US, Owning a Home May Not Lead to a Better Life

Economics & Finance

After the Fall, What’s Next for Crypto?

Economics & Finance

The Importance of Soft Skills in Driving Productivity

Economics & Finance

The Road Ahead for Venture Capital

Economics & Finance

China’s Economy: Dragon in Turbulence

Economics & Finance

Can Fintech Be a Force for Good?

Economics & Finance

A Perfect (Macroeconomic) Storm

Responsibility

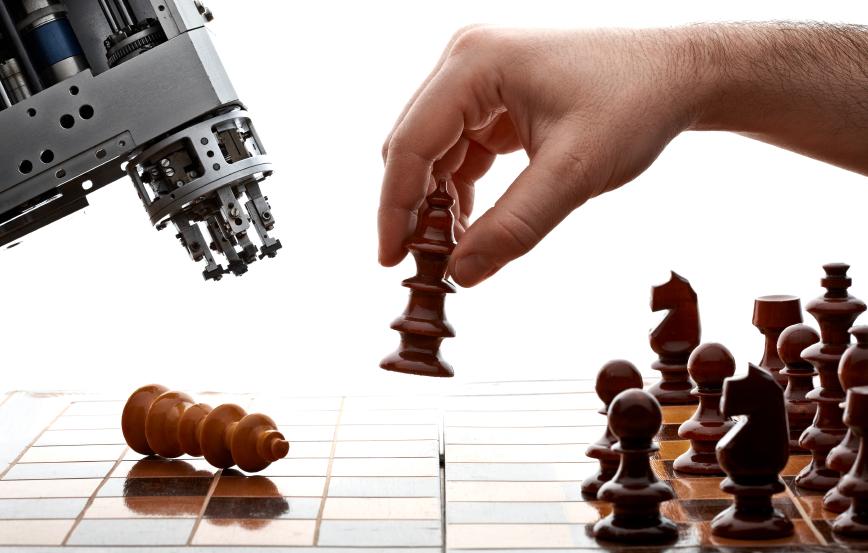

Responsible AI Has Become Critical for Business

Economics & Finance

Banning Payment for Order Flow May Benefit No One

Economics & Finance

Affordable Homes for the Poor Can Boost Collective Well-Being

Economics & Finance

Casting a Wider Net in OTC Trading: For Better or Worse?

Economics & Finance

A China Blockade of Taiwan Will Hurt Us All

Economics & Finance

Biden’s Misguided Tax on Share Buybacks

Responsibility

Bob Ayres at 90: Key Insights on Energy in the Economy

Economics & Finance

Too Many ESG Funds Mislead Investors

Economics & Finance

Don’t Kill Share Buybacks

Economics & Finance

Sales Numbers Are Up? It May Only Be Inflation

Economics & Finance

Where a Firm’s Value Truly Lies

Responsibility

Can Private Equity Make Money While Doing Good?

Economics & Finance

China’s Urban Rich and the Quest For Common Prosperity

Economics & Finance

The Unexpected Role of PE Firms in Reducing Within-Firm Pay Inequality

Economics & Finance

How DBS Became the ‘World’s Best Bank’

Economics & Finance

A Sign of the Times: The ESG Buyback

Leadership & Organisations

Aligning Individual and Organisational Values

Economics & Finance

Trust, Social Capital and the Bond Market Benefits of ESG

Economics & Finance

When Scandal Hits, It Pays to Resemble the Villain

Economics & Finance

In Global Trade, Familiarity Breeds Commerce

Economics & Finance

The Missing Millennial Homebuyers

Economics & Finance

How Africa Could Astonish the World

Economics & Finance

Rethinking Capitalism: The Power of Creative Destruction

Economics & Finance

When American Firms Misbehave, Chinese Companies Pay the Price

Economics & Finance

When Do Managers Have an Information Advantage Over Analysts?

Economics & Finance

There Goes the Neighbourhood: Legalised Marijuana and Property Values

Economics & Finance

Social Capital Makes the Difference Between ‘Good’ and ‘Bad’ Buybacks

Economics & Finance

Reverse Mergers Went Bust. Will SPACs Follow?

Economics & Finance

Who Wins the Market: The Swift or the Smart?

Economics & Finance

Can State and Shareholder Capitalism Combine?

Economics & Finance

What It’s Like to Be a Gig Worker During a Pandemic

Economics & Finance

Why Universal Basic Income Should Be President Biden’s Top Priority

Economics & Finance

In Bad Times, Decentralised Firms Outperform Their Rivals

Economics & Finance

Doing Good: Where Sustainable Investing Gets It Wrong

Economics & Finance

A Liquidity Cushion in Troubled Times: The PE Secondaries Market

Economics & Finance

Covid Cost-Cutting May Backfire in the Long Run

Economics & Finance

How Would an Immigration Surge Affect Your Pay Cheque?

Economics & Finance

How Trade Made the Richest 0.1% Even Richer

Economics & Finance

Introducing Excess Value: A Metric for Private Market Outperformance

Economics & Finance

How Universal Basic Income Could Save Capitalism

Economics & Finance

What’s Behind the Rising Inequality of Everything?

Economics & Finance

Can Investors Save the Planet While Making a Profit?

Economics & Finance

Corporate Funding Gap and the Role of Fintech

Economics & Finance

Covid-19 Furloughs Are Getting the Job Done

Economics & Finance

Has Venture Capital Strayed From Its Roots?

Economics & Finance

Impact Investing in Covid-19 Times: A Three-Step Mission

Economics & Finance

Private Equity’s COVID-19 Recovery Plan

Economics & Finance

To Save India’s Economy, Think Big, Blunt and Fast

Economics & Finance

Social Norms for the Era of Social Distancing

Economics & Finance

Three Keys to Ending the Great Lockdown

Economics & Finance

COVID-19: Four Reasons for Optimism About the Stock Market

Economics & Finance

The Shape of the COVID-19 Economic Recovery

Economics & Finance

COVID-19: A Turning Point for Inequality?

Economics & Finance

What China’s Cyber-Cash Advantage Means for the Global Economy

Strategy

The Changing Tides of the Global Economy

Economics & Finance

The Psychology Behind Coronavirus Panic Buying

Economics & Finance

The Problem With Politically Motivated Funding Boycotts

Economics & Finance

Turn the Office Into a Lab

Economics & Finance

Warning Tremors Before a Flash Crash

Economics & Finance

How the Daily Commute Affects the Gender Wage Gap

Economics & Finance

India’s Quiet Digital Revolution

Leadership & Organisations

When an 80-Hour Workweek Helps

Economics & Finance

A Hippocratic Oath for Corporations

Economics & Finance

Universal Basic Income: Lessons From a Failed Experiment

Economics & Finance

The Changing Face of Family Offices in Europe

Economics & Finance

Information About Differences Ultimately Leads to Profit

Economics & Finance

The Global Impact of the Trade Stand-Off Between Japan and South Korea

Economics & Finance

Less Than Zero: The New Normal for Interest Rates?

Economics & Finance

How Benchmarking Can Make Markets More Opaque

Economics & Finance

BRT: A New View of Corporations and Capitalism

Economics & Finance

BRT: The Fuzzy Purpose of the Corporation

Economics & Finance

BRT: The New Capitalism?

Economics & Finance

Cautious Creativity With Investment Funds: A Guide for Non-Profits

Economics & Finance

How the Volkswagen Scandal Turned ‘Made in Germany’ Into a Liability

Economics & Finance

Getting Rid of Gender Bias in Venture Capital

Economics & Finance

The Trick to Predicting Recessions

Economics & Finance

The High Cost of Being Private

Economics & Finance

How Charities Should Manage Their Cash

Economics & Finance

Why Managers – Now More Than Ever – Need to Understand Corporate Finance

Economics & Finance

When Should Non-Profits Invest More Adventurously?

Economics & Finance

Latin American Family Firms and the Path to Longevity

Economics & Finance

What Non-Profits Should Know Before Engaging With Money Managers

Economics & Finance

Creating More Economic Equality for Women

Economics & Finance

Is Full Employment Sustainable?

Economics & Finance

How PE and VC Are Closing the Gender Gap in Emerging Markets

Economics & Finance

What Non-Profits (and Governments) Need to Know About Investment Strategy

Economics & Finance

Viewing Healthcare Through the Lens of Economics

Economics & Finance

Gender Wage Gaps Close When They Are Disclosed

Economics & Finance

Finance as a Force for Good

Economics & Finance

The Growing Danger of EU Disintegration

Economics & Finance

Should Central Banks Start Issuing Cyber-Cash?

Economics & Finance

Four Strategies for Balancing Charities’ Investment Risks

Economics & Finance

The Five Archetypes That Define National Culture

Economics & Finance

The Return of Realpolitik and the Rise of Populism

Economics & Finance

Fact and Fantasy About Buybacks: The International Evidence

Economics & Finance

Charities and the Investment Risks They Face

Economics & Finance

The Growing Menace of Non-GAAP Measures

Economics & Finance

KPIs Should Never Be Tied to Compensation

Economics & Finance

The WTO Is Not Passé

Economics & Finance

Charities’ Path to Financial Longevity Begins With a Manifesto

Economics & Finance

Why Venture Capitalists Should Invest Like Poker Players

Economics & Finance

Unemployment Doesn’t Have to Be So Damaging

Economics & Finance

Can Private Equity Reinvent Itself as Patient Capital?

Economics & Finance

European Safe Bonds Are Unlikely to Attract Investment

Economics & Finance

How Charities Can Ensure Financial Longevity

Economics & Finance

ICOs and Financing Blockchain Projects

Economics & Finance

Business Model Innovation Comes to Private Equity

Economics & Finance

No End in Sight for the “New Normal” in Monetary Policy

Economics & Finance

Giving Workers Equal Representation on the Board

Economics & Finance

Impact Investing Comes Into Its Own

Economics & Finance

Impact Investing Business that Makes a Difference

Economics & Finance

The Paradox of Protectionist Populism

Economics & Finance

Still in the Danger Zone

Economics & Finance

How the Unbanked Can Save and Borrow

Economics & Finance

Who Suffers in a Trade War?

Economics & Finance

When Fintech Goes Green

Economics & Finance

Why Economists Should Think Like Plumbers

Economics & Finance

Short Sellers Hiding in the Noise

Economics & Finance

What the Productivity Paradox Means for Our Economic Future

Economics & Finance

Economic Narratives for 2018 Are Too Simplistic

Economics & Finance

Should We Fear the Robot Revolution?

Economics & Finance

Surviving the Generational Clash

Family Business

What Family Firms Need to Ensure Longevity

Economics & Finance

The Stock Market’s Potential as a Wealth Equaliser

Economics & Finance

Governments: The Next Heroes of Innovation

Economics & Finance

Retail Trading Ripe for Fintech Disruption

Economics & Finance

Why China Needs “Soft” Infrastructure Investment Now

Economics & Finance

Europe’s Single Resolution Mechanism Is Creating Instability

Economics & Finance

How Value Is Destroyed in Acquisitions and Disposals

Economics & Finance

The Virtuous Circle Between Financial Information and Innovation

Economics & Finance

Share Buybacks Are Corporate Suicide

Economics & Finance

How Private Investors Can Narrow the Global Infrastructure Gap

Economics & Finance

The Role of Digital in Financial Planning

Economics & Finance

The Dark and the Darker Sides of the Market

Economics & Finance

Banks Are Passing the Buck in Cost Cutting

Economics & Finance

Response to Henning Huenteler: Use Climate Funds to Deal With Consequences

Economics & Finance

Response to Professor Vermaelen: U.S. Climate Policy Is Based on Shaky Arguments

Economics & Finance

How In-Work Benefits Reduce Poverty

Economics & Finance

Trump’s Climate Policy is Based on Cost-Benefit Analysis

Economics & Finance

Why Your Financial Planner Should Be a Robot

Economics & Finance

Banks Are Still Thinking Short-Term

Economics & Finance

China’s Colonial Ambitions

Economics & Finance

A (Temporary) Reprieve for Europe

Economics & Finance

Private Secondary Markets: A Growing Investment Opportunity

Economics & Finance

How Invisible Inequality Hurts the Poor

Economics & Finance

A Recipe for Employee Motivation

Economics & Finance

Mortgage Foreclosures: A Necessary Evil?

Economics & Finance

The Economic Consequences of Shareholder Value Maximisation

Economics & Finance

The Stars Are Aligning for Socially Responsible Investing

Economics & Finance

What Are Trump’s Promises Really Worth?

Economics & Finance

Mix Enforcement With Persuasion

Economics & Finance

The Future for Share Buybacks Under Trump

Economics & Finance

The Implications of the EU vs. Apple Case

Economics & Finance

How Business Can Respond to Populist Pressures

Economics & Finance

Unilever: Why Firms Should Maximise Shareholder Value

Economics & Finance

How the Market Reacts to Media “Bias”

Economics & Finance

Anti-Takeover Provisions Backfire

Economics & Finance

Building a Cluster from the Outside In

Economics & Finance

Thinking in Scenarios Improves Forecasts

Economics & Finance

Financial Regulation in Volatile Markets

Economics & Finance

Are Investors Underpricing Current Risks?

Economics & Finance

The Future World Order

Economics & Finance

How to Model Our Future Cities?

Economics & Finance

Why You Should Give Investors Greater Say on CEO Pay

Economics & Finance

How China Can Innovate

Economics & Finance

Understanding Populism: Inequality by the Numbers

Economics & Finance

The End of Globalisation? How Executives Should Respond

Economics & Finance

Emerging Markets – The Comeback Story

Economics & Finance

What Really Matters Is Poverty, Not Income Inequality

Economics & Finance

The End of Globalisation?

Economics & Finance

Donald Trump: The Good, the Bad and the Ugly

Economics & Finance

Why the Intellectual Elite Can’t Learn Its Lesson

Economics & Finance

Hail the Populist Counter-Revolution!

Economics & Finance

Forget the Stereotypes About Conglomerates

Economics & Finance

The EU Cannot Be at the Mercy of the Few

Economics & Finance

Sensational News Distracts Retail Investors

Economics & Finance

Actually, the Stock Market Looks Cheap

Economics & Finance

The Ocean Cannot Absorb Much More CO2

Economics & Finance

Is Hillary Clinton Right About Share Buybacks?

Economics & Finance

The Climate Could Be More Sensitive to CO2 Than We Think

Economics & Finance

The Middle East’s New Oil Paradigm

Economics & Finance

The Factors That Create Outperforming Stars

Economics & Finance

Operational Improvement the Private Equity Way

Economics & Finance

European Union Faces Another Year of Living Dangerously

Economics & Finance

Settling the Debate on Climate Change

Economics & Finance

Why We Need Facts and Experts

Economics & Finance

Gender Diverse Boards May Have Less Inside Information

Economics & Finance

Commercial Real Estate Needs a Digital Transformation

Economics & Finance

The Brexit Breakup Brings New Opportunities

Economics & Finance

The Mixed Results of Motivational Rankings

Economics & Finance

Doing Good by Investing in Sin

Economics & Finance

The Cost of Being Associated with Tax Havens

Economics & Finance

Soft Stick Regulation Improves Disclosure

Economics & Finance

Ten Questions to Ask Before Pursuing an Acquisition

Economics & Finance

China’s Slowdown is a Natural Phenomenon

Economics & Finance

The Benefits of Inflating Inflation Expectations

Economics & Finance

Fintech Versus Banks: Déjà Vu?

Economics & Finance

The Cost of Geopolitics to M&As

Economics & Finance

The Innovation Potential of Human-Centred Cities

Economics & Finance

The Best-Case Scenario for Avoiding Brexit

Economics & Finance

How China Can Avoid the Middle Income Trap

Economics & Finance

Is Fintech Here to Stay?

Economics & Finance

Central Banks Need to Get Real (Not Nominal)

Economics & Finance

What Now For the European Central Bank?

Economics & Finance

Does Democracy Help or Hinder Growth?

Economics & Finance

The Road to Brexit and What it Would Mean

Economics & Finance

China: Years of Decline?

Economics & Finance

Aramco IPO: It’s Not About the Money

Economics & Finance

Have the BRICs Hit a Wall? The Next Emerging Markets

Economics & Finance

What “The Big Short” Gets Right—and Wrong

Economics & Finance

The Risks of Fast News Analytics and Institutional Trading

Economics & Finance

Keep Europe Borderless

Economics & Finance

Even in Non-Corrupt Countries, Political Power Pays Off

Economics & Finance

Fiscal Consolidations Make Crises Worse

Economics & Finance

A New Look at The Housing Market

Economics & Finance

Collaborating to Compete

Economics & Finance

Is The World Ready For the Next Recession?

Economics & Finance

Time for an Economic Rethink

Economics & Finance

The Double-Edged Sword of Globalisation

Economics & Finance

Where Are the Best Private Equity Returns?

Economics & Finance

Innovation Enriches the 1%, While Increasing Social Mobility

Economics & Finance

Protecting Minority Shareholders Pays

Economics & Finance

The Real Cause of Low Interest Rates

Economics & Finance

Why Do Governments So Often Disappoint?

Economics & Finance

The Left Has Found a New Enemy: Share Buybacks

Economics & Finance

It’s Time for the EU to Embrace Haircuts on Greek Debt

Economics & Finance

Hack Society

Economics & Finance

A Third Scenario for Stock Markets

Economics & Finance

Governing in an Age of Great Expectations

Economics & Finance

Who’s Afraid of BlackRock?

Economics & Finance

Do You Have What it Takes to Work in Private Equity?

Economics & Finance

How Greece Can Unite its People

Economics & Finance

Micromanaging European Reforms is Sowing Disunity

Economics & Finance

The Euro Is in Deep Trouble

Economics & Finance

Impact Investing in Future Leaders

Economics & Finance

Lack of Trust Is Preventing a Long-Term Greek Solution

Economics & Finance

Are Central Banks Keeping Interest Rates Artificially Low?

Economics & Finance

Why You Should Care About Family Office Values

Economics & Finance

Reforming Europe: It’s Time to Accept Differences

Economics & Finance

When Three’s a Crowd: How to Upset a Good Partnership

Economics & Finance

A Stand-off in Euroland: Athens on a Knife-Edge

Entrepreneurship

Capitalism: Making Altruism Sustainable

Economics & Finance

Competition Makes Bloggers Reckless

Economics & Finance

Is The Greek Dra(ch)ma Making a Comeback?

Economics & Finance

Is Urban Harmony Bad for Business?

Economics & Finance

Stop Selling!

Economics & Finance

The Future for Labour Is Self-Employment

Economics & Finance

Four Ways to Gain Positions of Power

Economics & Finance

Fighting Inequality Starts with Early Childhood Development

Leadership & Organisations

The Path of an Exemplary Leader

Economics & Finance

The Changing Face of Private Equity in Emerging Markets

Economics & Finance

How Business Schools Must Evolve

Economics & Finance

What’s Behind the September Stock Market Blues?

Economics & Finance

Let the Central Bankers Inflate

Economics & Finance

What China’s “New Normal” Means for Leaders

Economics & Finance

Making Pension Systems Stronger via Financial Markets

Economics & Finance

Where the Great Recession Took the Greatest Toll

Economics & Finance

Fast and Furious Finance Careers Are Things of the Past

Economics & Finance

Not the Debt, But the Future: The Crux of the Eurozone Crisis

Economics & Finance

Margin Call on Overleveraged China

Economics & Finance

The Dark Side of Social Media: Did Facebook, Twitter and YouTube Kill Charlie?

Economics & Finance

No Level Playing Field in After-School Activities

Economics & Finance

Are We Ready to Make Decisions for Our Retirement?

Economics & Finance

The Buyback Fund That Gives Back

Economics & Finance

This is How Greece Might Leave the Euro

Economics & Finance

Negotiating the Sydney Siege

Economics & Finance

The Logic Behind the German Euro Gamble

Economics & Finance

Why Business Schools Should Teach MBAs to Maximise Shareholder Value

Economics & Finance

Let's Talk About the Weakness of Capitalism

Economics & Finance

Is Refusing to Fight Climate Change Unethical?

Economics & Finance

Finding Opportunities to Make an Impact

Economics & Finance

ECB Should Aim Higher on Inflation

Economics & Finance

Are Today’s Regulations Sowing the Seeds of the Next Crisis?

Economics & Finance

“College for All” Isn’t a Cure-All for Inequality

Economics & Finance

Europe’s Power is Waning

Economics & Finance

The Permanent Scars of Fiscal Consolidation

Economics & Finance

What’s Influencing our Growth Expectations?

Economics & Finance

Diverging Monetary Policies: Bad News for the Euro?

Economics & Finance

Helicopter Mario (Draghi) to the Rescue

Economics & Finance

Creating Growth: Stimulate Demand or Supply?

Economics & Finance

Is the Next Recession Coming Soon?

Economics & Finance

Eurozone Growth: Stagnation or Recovery?

Economics & Finance

Not All Debt Booms Are Unsustainable

Economics & Finance

How to Energise Economic Recovery

Economics & Finance

Finding Value in the Environment

Economics & Finance

Addicted to Central Bank Painkillers?

Economics & Finance

Can Entrepreneurs Be Created?

Economics & Finance

How ECB Policy Could Stir Spending in the Private Sector

Economics & Finance

Does France Work Harder Than America?

Economics & Finance

The Death of Distance is Greatly Exaggerated!

Economics & Finance

The Asset Prices Are Too Damn High

Economics & Finance

Refocusing Economics Education

Economics & Finance

Honey, I Blew Up a Few Economies

Economics & Finance

Harnessing Data for Growth

Economics & Finance

The Contradiction in Economics

Economics & Finance

Secular Stagnation or Secular Boom?

Economics & Finance

Inflation in Europe: The Price is Wrong

Economics & Finance

Is a Lack of Financial Acumen Putting Your Company at Risk?

Economics & Finance

Private Equity’s Cautious Cash Pile

Economics & Finance

What Will it Take to Move the ECB?

Economics & Finance

The Ukrainian Crisis: The Finland Option

Economics & Finance

Breaking Down Silos to Achieve Strategic Agility

Economics & Finance

Should Comcast and Time Warner Cable Be Allowed to Merge?

Economics & Finance

Should Investors Worry About the Political Affiliation of CEOs?

Economics & Finance

Long term unemployment: cyclical or structural?

Economics & Finance

Financial Market Arbitrage: Reassuring or Lovely?

Economics & Finance

The Permanent Scars of Recession

Economics & Finance

Higher Education: Still Valuable, But Changing

Economics & Finance

Emerging Markets: The Future Is Now

Economics & Finance

Reading the ECB's Inaction

Economics & Finance

The Role of National Animosity in Business Partnerships

Economics & Finance

Are Economists Conservatively Biased?

Economics & Finance

Modernising Doesn’t Mean Westernising in Emerging Markets

Economics & Finance

Obesity in the Young Is Increasingly Class-Based

Economics & Finance

Net Neutrality: Time for a Bandwidth Market?

Economics & Finance

Growth vs. Earth?

Economics & Finance

Stimulus Deniers

Economics & Finance

Making the Right Decisions in a Recession

Economics & Finance

The Increasing Number of Euro Fools

Economics & Finance

France's Battle for Competitiveness

Economics & Finance

Doha Reborn, But Keep Making Baby Steps

Economics & Finance

When Will People Avoid Corporations?

Economics & Finance

Why the Iran Deal Was Beautiful

Economics & Finance

Marketing France as an Investment Destination

Economics & Finance

Four Missing Ingredients in Macroeconomic Models

Economics & Finance

Austerity Won't Win the War

Economics & Finance

Why FIFA Should Be Learning From Brazil

Economics & Finance

The Price of Wise Forecasting

Economics & Finance

From Stressed to Success: A Middle East Bank’s Turnaround

Economics & Finance

Where did the saving glut go?

Economics & Finance

Doing Good by Beating the Market

Economics & Finance

Stubborn Bankers

Economics & Finance

Standing Tall: Lady Gaga's Shoes and Young Artists

Economics & Finance

Typhoon Haiyan: The Disaster-Relief-Recovery Cycle Must Be Broken

Economics & Finance

Europe's Quagmire: Austerity or Lack of Reforms?

Economics & Finance

ECB Rate Cut Justified

Economics & Finance

Muted Recession Graduates

Economics & Finance

Google Under Attack -- Again

Economics & Finance

The Interrelated Market Efficiency Debate

Economics & Finance

Party Like It's 1995?

Economics & Finance

Creating Sustainable Business in a Conflict Zone

Economics & Finance

Exchange Rates Matter Less Than We Think (Part 3)

Economics & Finance

The Market Efficiency Debate is Alive and Kicking

Responsibility

Impact Investing: Unleashing Institutional Capital

Economics & Finance

Going Direct: The Case of Teachers’ Private Capital

Economics & Finance

Rebalance Climate Policy

Economics & Finance

Perspective: The 'London Whale'

Economics & Finance

Passion: I like the way you look

Economics & Finance

Sharing Big Pharma's Value

Economics & Finance

Building Ecosystem Alliances

Economics & Finance

Climate Science Politics at Full Speed

Economics & Finance

German Elections: Did Merkel Win Too 'Well'?

Economics & Finance

How to command attention and deliver a winning presentation

Marketing

Turning Expectations Into Customer Satisfaction

Economics & Finance

Journeying to Luxury's New Frontiers

Economics & Finance

How to Make Your Company More Creative? Hire a Senior Executive Who Worked Abroad

Economics & Finance

Germany United as Europe's Stable Core

Economics & Finance

Championing Telecoms Innovation in the Middle East

Economics & Finance

Boosting business confidence key to driving EU job creation

Economics & Finance

To Compete in Today's Global Economy, Germany Has Put Itself First

Economics & Finance

Comment: How Should Multinationals Be Taxed?

Economics & Finance

How Should Multinationals Be Taxed?

Economics & Finance

Luxury: Catering to the Super-Wealthy

Economics & Finance

Just who are the Very Rich Consumers?

Economics & Finance

Infosys at the Crossroads

Economics & Finance

Can Europe Regain Its Once-Competitive Edge?

Economics & Finance

Good News Can Explain Why Today’s Market is Not A Bubble in the Making

Economics & Finance

The Road to Economic Recovery: Clearing Skies, Bumps Ahead

Economics & Finance

What Lies Ahead for the Eurozone?

Economics & Finance

From Frontier to Emerging: What’s an Upgrade Worth?

Economics & Finance

Preventing a Run on the Bank

Economics & Finance

Risky Business: How Admiral Captured the U.K. Car Insurance Market

Economics & Finance

Emerging London

Economics & Finance

Businessmen are Impatient with Widening Gap Between Europe & the World

Economics & Finance

Building Skyscrapers in the Sand

Economics & Finance

Cities of the Future

Economics & Finance

Taking India Inc. Global

Economics & Finance

Fixing India’s Human Infrastructure

Economics & Finance

OECD Economic Outlook: Global Growth this Year

Economics & Finance

How to produce and deliver a winning presentation Part 1: Prepared Goals

Economics & Finance

Improving European Board Effectiveness – insights from participants of the INSEAD International Directors Programme

Economics & Finance

Russia’s Invisible Economy

Economics & Finance

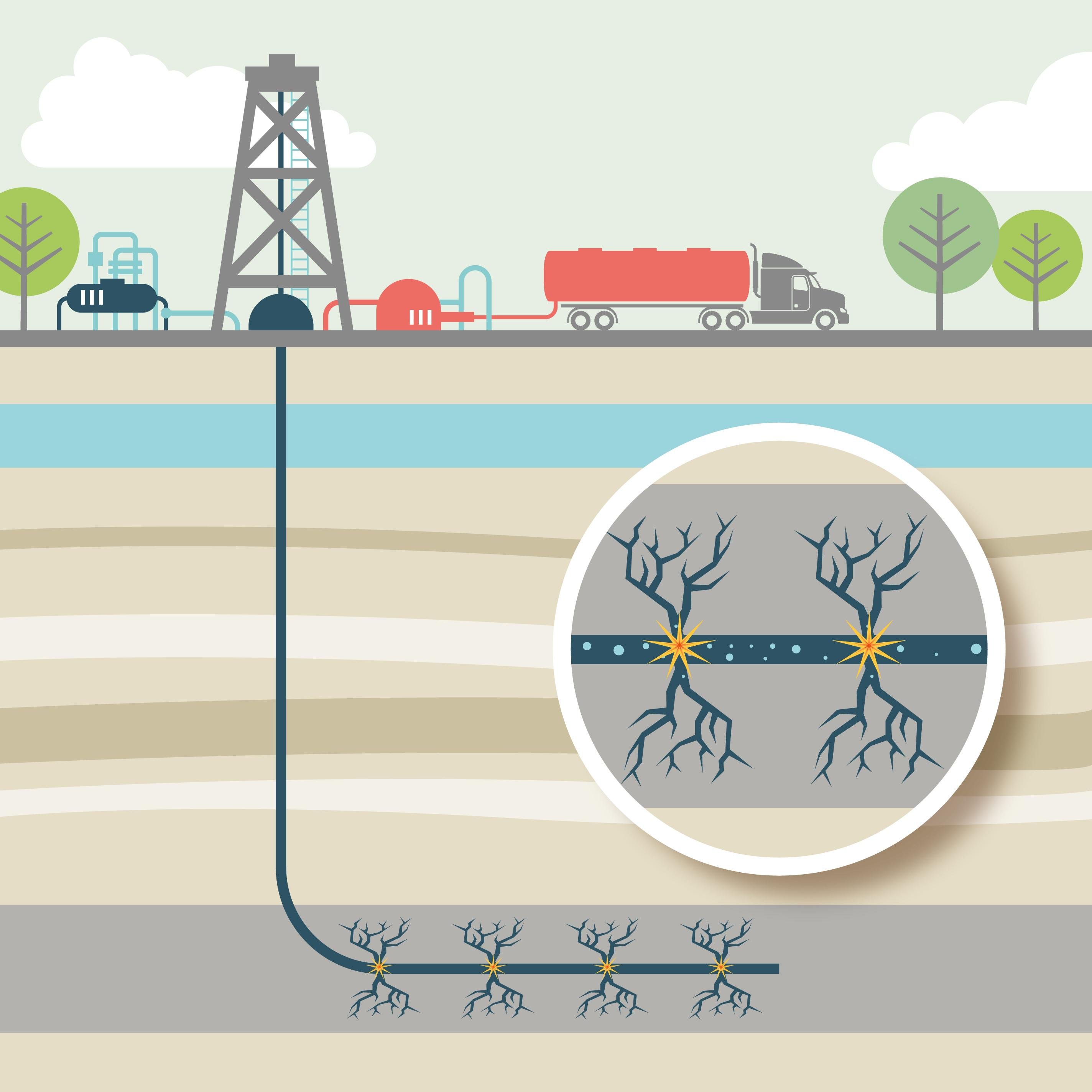

Shale Oil and Gas: The Contrarian View

Economics & Finance

Shale Gas and the Environment

Economics & Finance

Shale Gas: Hype or Hope?

Marketing

What’s in a Brand?

Career

Networking in the Middle East

Marketing

Clicks vs. Bricks: The Battle for the High Street

Economics & Finance

Transatlantic Trade: A Chance to Get it Right?

Economics & Finance

Doha Still the Best Way to Go

Economics & Finance

Why you need First Aid to be a great communicator and leader

Economics & Finance

India Business Dialogue Highlights

Leadership & Organisations

Arab Flair for International Women's Day

Economics & Finance

Europe’s shale gas competitiveness challenge and consequences for the petrochemical sector

Economics & Finance

The Wisdom of Default

Economics & Finance

Finding Growth at the Base of the Pyramid

Economics & Finance

China: No Demise in Sight

Economics & Finance

Ordering off the Menu: Entrepreneurship Arab-Style

Leadership & Organisations

The Abaya in the Boardroom

Economics & Finance

Best Advice: Tips for Success and Happiness

Economics & Finance

Socially Responsible Investments: alpha on earth or alpha in heaven?

Economics & Finance

How to unlock your genuine loving self

Economics & Finance

Extreme Focus and the Success of Germany’s Mittelstand

Economics & Finance

INSEAD Professors’ Fund Ranked Number One

Economics & Finance

Analyst Forecasts: How to Read Between the Lines

Economics & Finance

Energy, Money and Industrial Civilisation

Economics & Finance

Get a Little Help From Your Friends

Economics & Finance

SMEs Embrace the Bond Markets

Economics & Finance

It’s Not Enough to be Competitive

Economics & Finance

Where I Work: Happy Faces, Hungry Minds

Economics & Finance

How to be a genuinely masterful communicator

Entrepreneurship

Ecosystem Economics TM is the New Industrial Model

Economics & Finance

All That Glitters is not Gold

Economics & Finance

Italian Business: More Than Flashy Cars, Fashion, Families And Pasta

Economics & Finance

INSEAD Brings the MBA to Abu Dhabi

Economics & Finance

Les Etats De La France 2012

Economics & Finance

The Changing Face of Air Travel

Economics & Finance

What’s Ahead For 2013?

Economics & Finance

The Middle East Challenge in 2013

Economics & Finance

So You Think You Understand Asian Business?

Economics & Finance

Thomson Reuters/INSEAD Asia Business Sentiment Survey Shows Business Sentiment Rising

Economics & Finance

Business Model Innovation: The Gift that Keeps Giving

Economics & Finance

What Makes Industrial Excellence?

Economics & Finance

The New Cultural Revolution in China

Economics & Finance

China's New Ruling Elite: Scandals and Promises

Economics & Finance

Perfect Storms?

Economics & Finance

China Rising

Economics & Finance

2012 Tsinghua Management Global Forum

Economics & Finance

Deal-making in China: More Than Money

Economics & Finance

When Investing Has an Impact

Strategy

In Defence of Military Procurement

Responsibility

Going Green – Or Else: The Dilemma Facing Abu Dhabi

Economics & Finance

The Changing of the Guard: China’s New Leadership

Economics & Finance

Super Storm Sandy: The Aftermath

Economics & Finance

Gender quotas for boards: how to destroy European Competitiveness

Economics & Finance

Movie-making In Abu Dhabi

Economics & Finance

Competitiveness In Europe

Economics & Finance

U.S. Elections Comments

Economics & Finance

The Competitiveness Challenge of European Manufacturers: The Case of Michelin

Economics & Finance

Nobel Prize for a Noble Cause – Under Threat

Economics & Finance

How a Scandinavian Firm can teach The World on how to use Social Media inside their Organizations

Economics & Finance

Google and France (and Europe)

Economics & Finance

Merger Control and Practice in the BRIC Countries vs. the EU and the US: The Timing

Economics & Finance

China’s Africa Policy

Economics & Finance

Austerity Hurts. But Does It Work?

Economics & Finance

China Finds Bargains in Germany

Economics & Finance

Africa Means Business: Opportunities in Frontier Markets

Economics & Finance

CNOOC-Nexen: Global Resources Landscape Shifts Eastward

Economics & Finance

Could Women’s Rights be Sacrificed for Peace in Afghanistan?

Economics & Finance

Making car manufacturing sane: Business Model Innovation at Volkswagen

Economics & Finance

Merger Control and Practice in the BRIC Countries vs. the EU and the US: Review Thresholds

Economics & Finance

Banksters: The scandals continue

Economics & Finance

How to succeed when the market shrinks

Strategy

Euronews: Confronting the revolution

Economics & Finance

The year of the austerity Olympics

Leadership & Organisations

Meet China’s top executives

Economics & Finance

The moment of truth has arrived

Economics & Finance

The future of European competitiveness

Economics & Finance

From Brussels to Bombay: The euro crisis could spread

Economics & Finance

Africa: The next frontier for investors?

Strategy

Are you creating value for your firm?

Entrepreneurship

An Online Travel Startup Grows Up

Responsibility

Combatting diabetes: Some things money can’t buy

Leadership & Organisations

Corruption: A piecemeal solution

Economics & Finance

Will multinationals from the emerging world take over?

Economics & Finance

Roland Berger: Rating Europe

Entrepreneurship

The high cost of connectivity: it’s not just you who’s paying

Economics & Finance

Business and the euro

Economics & Finance

British style: Austerity wears a party mask

Economics & Finance

Forget austerity? Not completely, say economists

Economics & Finance

Don’t just pine for economic recovery! Roll up your sleeves!

Economics & Finance

So it’s the euro, not the drachma…

Economics & Finance

Carrefour: the new Kmart?

Economics & Finance

Merger Control in the BRIC Countries vs. the EU and the US: The Facts

Strategy

Where are Europe’s gazelles?

Economics & Finance

Moving up the ranks

Economics & Finance

New challenges for Islamic states

Economics & Finance

Can Egypt rise like a phoenix from its economic ashes?

Economics & Finance

Are we headed for just another jobless recovery?

Economics & Finance

No newspaper today? Watch stock market volumes shrink

Economics & Finance

Louis Vuitton or Hermès?

Economics & Finance

Why are Chinese consumers crazy for Apple?

Economics & Finance

Consumer spending in China

Economics & Finance

New or improved: What consumers really want

Career

Banking on Russia’s future

Economics & Finance

Betting on the little guy

Economics & Finance

What’s wrong with banking regulation today?

Entrepreneurship

Bang Bang Films: Creating a commercial revolution in India

Marketing

Selling soap to Nigeria: One Indian conglomerate goes beyond

Leadership & Organisations

Putting Arab women in the picture

Strategy

Bumpy roads in the sky

Responsibility

Entrepreneurship awards and grants: are they worth the chall

Economics & Finance

The Russians are coming!

Economics & Finance

Benefit from the networks of your lost employees

Economics & Finance

How the rich got richer

Economics & Finance

What makes an emerging market?

Economics & Finance

Egypt in transition

Economics & Finance

Botswana comes of age

Economics & Finance

EasyCredit: Bucking the tight money trend

Economics & Finance

Missing elements in the inequality debate

Economics & Finance

Pension reform: Juggling aging and money

Economics & Finance

Economic recovery: A long road with new horizons

Economics & Finance

The ten principles for doing business in China

Economics & Finance

The Big Day for the Fed

Economics & Finance

Europe: a global power with global reach?

Economics & Finance

Beyond Oil

Economics & Finance

How China is managing Western hostility

Economics & Finance

Beyond downgrades: Seeking signs of recovery

Economics & Finance

Can Asia sustain the world?

Economics & Finance

India’s top-performing CEOs

Economics & Finance

Emerging markets

Economics & Finance

Occupy Wall Street is not a machine. It’s a work of art.

Economics & Finance

Art insurance: where beauty meets the beast

Economics & Finance

From grass huts to halls of ivy: Can money buy academic exce

Economics & Finance

Eurozone: State of siege

Economics & Finance

Repairing Europe and reviving the US

Economics & Finance

Dangers on the horizon for China

Economics & Finance

Islamic banking comes out of its niche

Economics & Finance

Storm clouds in the Pacific

Entrepreneurship

Renault-Nissan: Building with BRICs

Economics & Finance

Too much demand, too little space

Responsibility

Who cares for society?

Economics & Finance

Sub-prime mortgages and segregation

Economics & Finance

Can Russia end corruption?

Economics & Finance

The corruption trap

Economics & Finance

Arab oil money: Empowering Women

Economics & Finance

What kind of recession is this?

Economics & Finance

There is no Chinese wall around the economy

Economics & Finance

What's behind the UK riots?

Economics & Finance

Can the economic crisis encourage European unity?

Economics & Finance

Bridging the gulf

Economics & Finance

Handing out some radical Asian philanthropy

Economics & Finance

Market moves: Not what you learned in B-School

Economics & Finance

The crisis you can’t see: New rescue package needed

Economics & Finance

Fanning the financial crisis: Has regulation gone wrong?

Economics & Finance

Trading places

Economics & Finance

M&As in China: do politics still speak louder than money?

Entrepreneurship

Is there a place for entrepreneurs in the Arab world?

Economics & Finance

Private equity comes of age

Economics & Finance

Luxury sector goes viral

Economics & Finance

Is Europe’s economic power in decline?

Economics & Finance

Emiratisation: The way forward?

Economics & Finance

How does media coverage affect share prices?

Economics & Finance

Luxury and the Abaya: The Middle East makes its mark

Economics & Finance

India’s growth finds fuel in Africa

Economics & Finance

China sharpens its Africa focus

Economics & Finance

Can Africa unlock its potential?

Economics & Finance

Depression or Recession? Parallels with 1929

Economics & Finance

Are we really in a recovery?

Economics & Finance

Rats replace doctors in pioneering disease diagnosis

Economics & Finance

Irish unions seek a soft landing to harsh economic measures

Economics & Finance

A tale of two Telefonicas - Spain rings Latin America for he

Economics & Finance

Germany: Divided by a common currency

Economics & Finance

The European Union: One crisis too many?

Economics & Finance

InnovaLatino Survey: Surprises in Latin America

Economics & Finance

OECD Economic Outlook

Economics & Finance

Who should shoulder the cost of bank bailouts?

Economics & Finance

UK economy: Trimming the fat or incipient anorexia?

Economics & Finance

When profits are private and losses are public

Economics & Finance

Attitude is everything: The case for Turkey

Economics & Finance

Looking ahead for the Middle East

Economics & Finance

Can there be financial transformation in the Middle East?

Economics & Finance

China and luxury: A rekindled romance

Marketing

Fast fashion meets luxury labels

Economics & Finance

Gallup polls take stock of the Muslim world

Economics & Finance

Arab youths, revolutions, rise of the ‘second society'

Economics & Finance

Assessing the economic aftershocks

Family Business

Andrea Illy: The man behind a good cup of coffee

Family Business

Trouble at the family mill?

Economics & Finance

Real estate in the UAE: from speculation to solid value?

Entrepreneurship

‘Question everything’

Economics & Finance

CEO view: Gary Wang (MBA ‘02J), founder of Tudou.com

Entrepreneurship

Western economies need to adapt

Entrepreneurship

Pushing the boundaries: innovation or imitation.

Economics & Finance

What next after human capital, infrastructure, and good gove

Economics & Finance

Trading places

Economics & Finance

Navigating Asia’s private equity markets

Economics & Finance

Bank investments in private equity: an unfair advantage?

Economics & Finance

Private equity in Asia

Economics & Finance

The big picture from West to East

Economics & Finance

Cargill’s business longevity in China

Marketing

Indo-vation: tapping the Indian market

Responsibility

Emerging economies in healthcare

Economics & Finance

Why the French love social conflict

Economics & Finance

On pricing anomalies and the limits of arbitrage

Economics & Finance

Building an Asian bank

Responsibility

A view of the Indian Healthcare landscape

Economics & Finance

Between property boom and bust

Leadership & Organisations

Why diversity matters

Economics & Finance

Foreign firms eye China’s rural markets

Economics & Finance

Getting back to basics in a world of luxury

Economics & Finance

The heat is on

Economics & Finance

Coming of age

Economics & Finance

Due diligence in China’s private equity market

Economics & Finance

The upside of a down market

Strategy

M&As: Not necessarily the best way to grow your company

Economics & Finance

Exploring the consequences

Responsibility

A unique opportunity

Economics & Finance

Lessons from Germany’s banking crisis

Economics & Finance

MBC: Building a media powerhouse in an emerging market

Economics & Finance

China’s progress: can it breach the Great Wall?

Economics & Finance

Putting Europe back on track

Economics & Finance

Private equity’s challenge in the Middle East

Responsibility

The path to energy futures

Economics & Finance

China’s foreign policy

Economics & Finance

Sustainable practices: engaging consumers and suppliers

Economics & Finance

EU-China relations

Economics & Finance

Message to Basel: Another way to avoid bank bailouts

Economics & Finance

It's time that politicians had performance-related bonuses

Leadership & Organisations

Prosperity through partnership

Economics & Finance

‘Intoxicated’ institutional investors

Economics & Finance

Doing it the Chinese way

Economics & Finance

Lessons learned: The Nordic banking crisis of the 1990s

Economics & Finance

Getting back to basics

Economics & Finance

Making more from less

Family Business

Braving the economic crisis through family values

Leadership & Organisations

Is it over yet? Businessmen offer recession insight

Economics & Finance

Rebuilding Europe

Economics & Finance

Upstart: China’s emergence in technology and innovation

Economics & Finance

Infrastructure key to Africa’s growth: Asia has role to play

Economics & Finance

The tortoise and the hare?

Economics & Finance

In search of an effective innovation policy

Economics & Finance

Microfinance comes of age

Economics & Finance

China’s property bubble

Economics & Finance

Advice to direct marketers: let the people do the talking

Economics & Finance

Investing in unknown stocks could yield higher returns

Economics & Finance

On the loss of legitimacy and contagion of scandals

Economics & Finance

Poorly Made in China: a reality check

Marketing

Leapfrogging over the Joneses

Economics & Finance

The Lehman fallout

Economics & Finance

Gaining a competitive advantage with knowledge-based skills

Economics & Finance

China and the threat of protectionism

Economics & Finance

Greed and deception: Is it too late for ethical banking?

Economics & Finance

Looking to the future: Fahad Al-Raqbani

Economics & Finance

Polling the wisdom of the people

Economics & Finance

A lesson in leadership: turning vision into reality

Economics & Finance

New paradigm needed

Economics & Finance