Economics & Finance

Strategy

INSEAD Insights: March 2024 Research Picks

Economics & Finance

Will the Shifting Economic Power Balance Topple Democracy?

Economics & Finance

Key Players in the Indo-Pacific Region

Economics & Finance

Bridging Prosperity and Need

Economics & Finance

When Firms Behave Irrationally

Strategy

Why Some CEOs Are More Likely to Downsize

Economics & Finance

The World Economy in 2024: Are We Back on Track?

Responsibility

The Risks and Rewards of Community-Driven Business Models

Economics & Finance

When Information Won’t Reduce Stock Price Volatility Immediately

Economics & Finance

How Web3 and AI Will Transform Finance

Economics & Finance

INSEAD Insights: December 2023 Research Picks

Economics & Finance

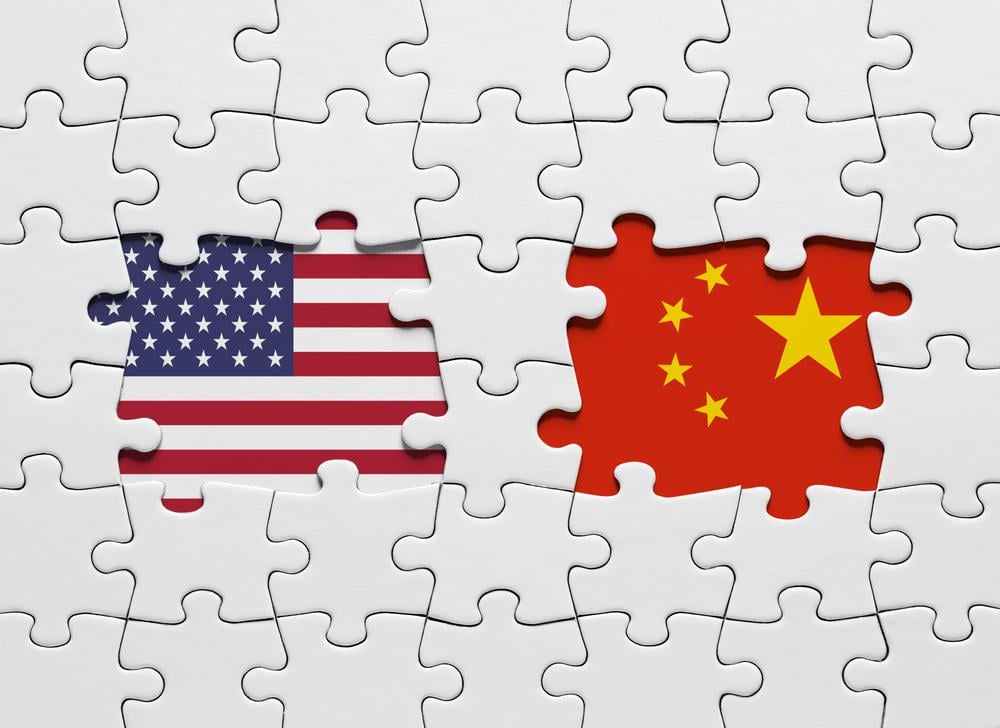

Thawing US-China Relations: Competition Meets Interdependence

Career

INSEAD Insights: October 2023 Research Picks

Economics & Finance

China: Caught in the Middle-Income Trap?

Economics & Finance

Pay Attention to the Details

Economics & Finance

Deflation Woes: Can China Avoid Japanification?

Economics & Finance

Covid-19 Furloughs Helped Firms Thrive

Economics & Finance

Managing Systemic Risks in Tech: Lessons from Finance

Economics & Finance

Better Geographic Investing Begins With an Inclusive Index

Economics & Finance

Why Demographics Matters More Than Ever for Businesses

Economics & Finance

US-China Ties: Damage Controlled But Obstacles Ahead

Economics & Finance

The Future of Energy Transition and Climate Finance

Economics & Finance

What Comes After the Fall of Silicon Valley Bank?

Economics & Finance

The Costs of Fuelling Economic Growth

Economics & Finance

Why Did Silicon Valley Bank Collapse?

Economics & Finance

Will ESG Investing Solve Our Pressing Problems?

Economics & Finance

The World Economy in 2023: A Recession Year?

Economics & Finance

China is Back: What Its Reopening Means for the World

Responsibility

Five Global Trends in Business and Society in 2023

Economics & Finance

In the US, Owning a Home May Not Lead to a Better Life

Economics & Finance

After the Fall, What’s Next for Crypto?

Economics & Finance

The Importance of Soft Skills in Driving Productivity

Economics & Finance

The Road Ahead for Venture Capital

Economics & Finance

China’s Economy: Dragon in Turbulence

Economics & Finance

Can Fintech Be a Force for Good?

Economics & Finance

A Perfect (Macroeconomic) Storm

Responsibility

Responsible AI Has Become Critical for Business

Economics & Finance

Banning Payment for Order Flow May Benefit No One

Economics & Finance

Affordable Homes for the Poor Can Boost Collective Well-Being

Economics & Finance

Casting a Wider Net in OTC Trading: For Better or Worse?

Economics & Finance

A China Blockade of Taiwan Will Hurt Us All

Economics & Finance

Biden’s Misguided Tax on Share Buybacks

Responsibility

Bob Ayres at 90: Key Insights on Energy in the Economy

Economics & Finance

Too Many ESG Funds Mislead Investors

Economics & Finance

Don’t Kill Share Buybacks

Economics & Finance

Sales Numbers Are Up? It May Only Be Inflation

Economics & Finance

Where a Firm’s Value Truly Lies

Responsibility

Can Private Equity Make Money While Doing Good?

Economics & Finance

China’s Urban Rich and the Quest For Common Prosperity

Economics & Finance

The Unexpected Role of PE Firms in Reducing Within-Firm Pay Inequality

Economics & Finance

How DBS Became the ‘World’s Best Bank’

Economics & Finance

A Sign of the Times: The ESG Buyback

Leadership & Organisations

Aligning Individual and Organisational Values

Economics & Finance

Trust, Social Capital and the Bond Market Benefits of ESG

Economics & Finance

When Scandal Hits, It Pays to Resemble the Villain

Economics & Finance

In Global Trade, Familiarity Breeds Commerce

Economics & Finance

The Missing Millennial Homebuyers

Economics & Finance

How Africa Could Astonish the World

Economics & Finance

Rethinking Capitalism: The Power of Creative Destruction

Economics & Finance

When American Firms Misbehave, Chinese Companies Pay the Price

Economics & Finance

When Do Managers Have an Information Advantage Over Analysts?

Economics & Finance

There Goes the Neighbourhood: Legalised Marijuana and Property Values

Economics & Finance

Social Capital Makes the Difference Between ‘Good’ and ‘Bad’ Buybacks

Economics & Finance

Reverse Mergers Went Bust. Will SPACs Follow?

Economics & Finance

Who Wins the Market: The Swift or the Smart?

Economics & Finance

Can State and Shareholder Capitalism Combine?

Economics & Finance

What It’s Like to Be a Gig Worker During a Pandemic

Economics & Finance

Why Universal Basic Income Should Be President Biden’s Top Priority

Economics & Finance

In Bad Times, Decentralised Firms Outperform Their Rivals

Economics & Finance

Doing Good: Where Sustainable Investing Gets It Wrong

Economics & Finance

A Liquidity Cushion in Troubled Times: The PE Secondaries Market

Economics & Finance

Covid Cost-Cutting May Backfire in the Long Run

Economics & Finance

How Would an Immigration Surge Affect Your Pay Cheque?

Economics & Finance

How Trade Made the Richest 0.1% Even Richer

Economics & Finance

Introducing Excess Value: A Metric for Private Market Outperformance

Economics & Finance

How Universal Basic Income Could Save Capitalism

Economics & Finance

What’s Behind the Rising Inequality of Everything?

Economics & Finance

Can Investors Save the Planet While Making a Profit?

Economics & Finance

Corporate Funding Gap and the Role of Fintech

Economics & Finance

Covid-19 Furloughs Are Getting the Job Done

Economics & Finance

Has Venture Capital Strayed From Its Roots?

Economics & Finance

Impact Investing in Covid-19 Times: A Three-Step Mission

Economics & Finance

Private Equity’s COVID-19 Recovery Plan

Economics & Finance

To Save India’s Economy, Think Big, Blunt and Fast

Economics & Finance

Social Norms for the Era of Social Distancing

Economics & Finance

Three Keys to Ending the Great Lockdown

Economics & Finance

COVID-19: Four Reasons for Optimism About the Stock Market

Economics & Finance

The Shape of the COVID-19 Economic Recovery

Economics & Finance

COVID-19: A Turning Point for Inequality?

Economics & Finance

What China’s Cyber-Cash Advantage Means for the Global Economy

Strategy

The Changing Tides of the Global Economy

Economics & Finance

The Psychology Behind Coronavirus Panic Buying

Economics & Finance

The Problem With Politically Motivated Funding Boycotts

Economics & Finance

Turn the Office Into a Lab

Economics & Finance

Warning Tremors Before a Flash Crash

Economics & Finance

How the Daily Commute Affects the Gender Wage Gap

Economics & Finance

India’s Quiet Digital Revolution

Leadership & Organisations

When an 80-Hour Workweek Helps

Economics & Finance

A Hippocratic Oath for Corporations

Economics & Finance

Universal Basic Income: Lessons From a Failed Experiment

Economics & Finance

The Changing Face of Family Offices in Europe

Economics & Finance

Information About Differences Ultimately Leads to Profit

Economics & Finance

The Global Impact of the Trade Stand-Off Between Japan and South Korea

Economics & Finance

Less Than Zero: The New Normal for Interest Rates?

Economics & Finance

How Benchmarking Can Make Markets More Opaque

Economics & Finance

BRT: A New View of Corporations and Capitalism

Economics & Finance

BRT: The Fuzzy Purpose of the Corporation

Economics & Finance

BRT: The New Capitalism?

Economics & Finance

Cautious Creativity With Investment Funds: A Guide for Non-Profits

Economics & Finance

How the Volkswagen Scandal Turned ‘Made in Germany’ Into a Liability

Economics & Finance

Getting Rid of Gender Bias in Venture Capital

Economics & Finance

The Trick to Predicting Recessions

Economics & Finance

The High Cost of Being Private

Economics & Finance

How Charities Should Manage Their Cash

Economics & Finance

Why Managers – Now More Than Ever – Need to Understand Corporate Finance

Economics & Finance

When Should Non-Profits Invest More Adventurously?

Economics & Finance

Latin American Family Firms and the Path to Longevity

Economics & Finance

What Non-Profits Should Know Before Engaging With Money Managers

Economics & Finance

Creating More Economic Equality for Women

Economics & Finance

Is Full Employment Sustainable?

Economics & Finance

How PE and VC Are Closing the Gender Gap in Emerging Markets

Economics & Finance

What Non-Profits (and Governments) Need to Know About Investment Strategy

Economics & Finance

Viewing Healthcare Through the Lens of Economics

Economics & Finance

Gender Wage Gaps Close When They Are Disclosed

Economics & Finance

Finance as a Force for Good

Economics & Finance

The Growing Danger of EU Disintegration

Economics & Finance

Should Central Banks Start Issuing Cyber-Cash?

Economics & Finance

Four Strategies for Balancing Charities’ Investment Risks

Economics & Finance

The Five Archetypes That Define National Culture

Economics & Finance

The Return of Realpolitik and the Rise of Populism

Economics & Finance

Fact and Fantasy About Buybacks: The International Evidence

Economics & Finance

Charities and the Investment Risks They Face

Economics & Finance

The Growing Menace of Non-GAAP Measures

Economics & Finance

KPIs Should Never Be Tied to Compensation

Economics & Finance

The WTO Is Not Passé

Economics & Finance

Charities’ Path to Financial Longevity Begins With a Manifesto

Economics & Finance

Why Venture Capitalists Should Invest Like Poker Players

Economics & Finance

Unemployment Doesn’t Have to Be So Damaging

Economics & Finance

Can Private Equity Reinvent Itself as Patient Capital?

Economics & Finance

European Safe Bonds Are Unlikely to Attract Investment

Economics & Finance

How Charities Can Ensure Financial Longevity

Economics & Finance

ICOs and Financing Blockchain Projects

Economics & Finance

Business Model Innovation Comes to Private Equity

Economics & Finance

No End in Sight for the “New Normal” in Monetary Policy

Economics & Finance

Giving Workers Equal Representation on the Board

Economics & Finance

Impact Investing Comes Into Its Own

Economics & Finance

Impact Investing Business that Makes a Difference

Economics & Finance

The Paradox of Protectionist Populism

Economics & Finance

Still in the Danger Zone

Economics & Finance

How the Unbanked Can Save and Borrow

Economics & Finance

Who Suffers in a Trade War?

Economics & Finance

When Fintech Goes Green

Economics & Finance

Why Economists Should Think Like Plumbers

Economics & Finance

Short Sellers Hiding in the Noise

Economics & Finance

What the Productivity Paradox Means for Our Economic Future

Economics & Finance

Economic Narratives for 2018 Are Too Simplistic

Economics & Finance

Should We Fear the Robot Revolution?

Economics & Finance

Surviving the Generational Clash

Family Business

What Family Firms Need to Ensure Longevity

Economics & Finance

The Stock Market’s Potential as a Wealth Equaliser

Economics & Finance

Governments: The Next Heroes of Innovation

Economics & Finance

Retail Trading Ripe for Fintech Disruption

Economics & Finance

Why China Needs “Soft” Infrastructure Investment Now

Economics & Finance

Europe’s Single Resolution Mechanism Is Creating Instability

Economics & Finance

How Value Is Destroyed in Acquisitions and Disposals

Economics & Finance

The Virtuous Circle Between Financial Information and Innovation

Economics & Finance

Share Buybacks Are Corporate Suicide

Economics & Finance

How Private Investors Can Narrow the Global Infrastructure Gap

Economics & Finance

The Role of Digital in Financial Planning

Economics & Finance

The Dark and the Darker Sides of the Market

Economics & Finance

Banks Are Passing the Buck in Cost Cutting

Economics & Finance

Response to Henning Huenteler: Use Climate Funds to Deal With Consequences

Economics & Finance

Response to Professor Vermaelen: U.S. Climate Policy Is Based on Shaky Arguments

Economics & Finance

How In-Work Benefits Reduce Poverty

Economics & Finance

Trump’s Climate Policy is Based on Cost-Benefit Analysis

Economics & Finance

Why Your Financial Planner Should Be a Robot

Economics & Finance

Banks Are Still Thinking Short-Term

Economics & Finance

China’s Colonial Ambitions

Economics & Finance

A (Temporary) Reprieve for Europe

Economics & Finance

Private Secondary Markets: A Growing Investment Opportunity

Economics & Finance

How Invisible Inequality Hurts the Poor

Economics & Finance

A Recipe for Employee Motivation

Economics & Finance

Mortgage Foreclosures: A Necessary Evil?

Economics & Finance

The Economic Consequences of Shareholder Value Maximisation

Economics & Finance

The Stars Are Aligning for Socially Responsible Investing

Economics & Finance

What Are Trump’s Promises Really Worth?

Economics & Finance

Mix Enforcement With Persuasion

Economics & Finance

The Future for Share Buybacks Under Trump

Economics & Finance

The Implications of the EU vs. Apple Case

Economics & Finance

How Business Can Respond to Populist Pressures

Economics & Finance

Unilever: Why Firms Should Maximise Shareholder Value

Economics & Finance

How the Market Reacts to Media “Bias”

Economics & Finance

Anti-Takeover Provisions Backfire

Economics & Finance

Building a Cluster from the Outside In

Economics & Finance

Thinking in Scenarios Improves Forecasts

Economics & Finance

Financial Regulation in Volatile Markets

Economics & Finance

Are Investors Underpricing Current Risks?

Economics & Finance

The Future World Order

Economics & Finance

How to Model Our Future Cities?

Economics & Finance

Why You Should Give Investors Greater Say on CEO Pay

Economics & Finance

How China Can Innovate

Economics & Finance

Understanding Populism: Inequality by the Numbers

Economics & Finance

The End of Globalisation? How Executives Should Respond

Economics & Finance

Emerging Markets – The Comeback Story

Economics & Finance

What Really Matters Is Poverty, Not Income Inequality

Economics & Finance

The End of Globalisation?

Economics & Finance

Donald Trump: The Good, the Bad and the Ugly

Economics & Finance

Why the Intellectual Elite Can’t Learn Its Lesson

Economics & Finance

Hail the Populist Counter-Revolution!

Economics & Finance

Forget the Stereotypes About Conglomerates

Economics & Finance

The EU Cannot Be at the Mercy of the Few

Economics & Finance

Sensational News Distracts Retail Investors

Economics & Finance

Actually, the Stock Market Looks Cheap

Economics & Finance

The Ocean Cannot Absorb Much More CO2

Economics & Finance

Is Hillary Clinton Right About Share Buybacks?

Economics & Finance

The Climate Could Be More Sensitive to CO2 Than We Think

Economics & Finance

The Middle East’s New Oil Paradigm

Economics & Finance

The Factors That Create Outperforming Stars

Economics & Finance

Operational Improvement the Private Equity Way

Economics & Finance

European Union Faces Another Year of Living Dangerously

Economics & Finance

Settling the Debate on Climate Change

Economics & Finance

Why We Need Facts and Experts

Economics & Finance

Gender Diverse Boards May Have Less Inside Information

Economics & Finance