Corporate Governance

Established in 2010, the INSEAD Corporate Governance Centre (ICGC) has been actively engaged in making a distinctive contribution to the knowledge and practice of corporate governance. Its vision is to be the driving force in a vibrant intellectual community that contributes to academic and real-world impact in corporate governance globally.

The ICGC harnesses faculty expertise across multiple disciplines to teach and research on the challenges of boards of directors in an international context. The centre also fosters global dialogue on governance issues, with the ultimate goal of developing high-performing boards. Through its educational portfolio and advocacy, the ICGC seeks to build greater trust among the public and stakeholder communities, so that the businesses of today become a strong force for good for the economy, society and the environment.

Leadership & Organisations

Are Boards Forward-Thinking Enough in this Disruption Era?

Leadership & Organisations

Winning the Game of Boardroom Chess

Leadership & Organisations

OpenAI's Crisis Is Yet Another Wake-Up Call

Leadership & Organisations

Ten Ways Boards Need to Transform

Strategy

Shareholder Activism at What Price?

Leadership & Organisations

How Leadership Shapes Sustainability Governance

Strategy

The Importance of Strategic Minds

Leadership & Organisations

Governance in the Age of Technological Innovation

Entrepreneurship

What All Tech Start-Ups Need to Succeed

Entrepreneurship

The Power of Governance for Tech Start-Up Success

Responsibility

In Times of Chaos, Know Yourself

Strategy

Managing in an Unimaginable World

Responsibility

Rising to the ESG Challenge: Towards Effective Governance

Leadership & Organisations

The X Factor in Crafting New CXO Roles Successfully

Leadership & Organisations

What the World Can Learn From Nordic Boards

Responsibility

Climate Change Gets Up Close and Personal for Board Members

Operations

‘Tech for Good’ Needs a ‘Good Tech’ Approach

Leadership & Organisations

Senior Leaders As Chief Reframing Officers

Leadership & Organisations

AI: A World of New Opportunity and Risk

Leadership & Organisations

How Nasdaq’s Board Diversity Rule Creates Potential for Real Change

Responsibility

Leading Climate Strategy From the Board

Responsibility

Using Corporate Social Initiatives to Build a Purpose-Driven Organisation

Responsibility

The Sustainability Imperative for the Legal Profession

Leadership & Organisations

Aligning Individual and Organisational Values

Strategy

CEOs Who Play to Type Win the Market

Responsibility

Encouraging Sustainability: Why the Business Case Isn’t Enough

Strategy

The Relationships That Create Successful Acquisitions

Responsibility

Three Ways Digitalisation Changes Corporate Responsibility

Family Business

When Nepotism Pads CEO Pay: Evidence From Indian Family Firms

Strategy

Do CEOs Matter?

Leadership & Organisations

The Next Decade Will Be a Leadership Game Changer

Leadership & Organisations

The Group Dynamics That Define Well-Functioning Boards

Leadership & Organisations

What Ails Corporate Executive Committees?

Responsibility

How Boards Can Steer Companies to “Build Back Better”

Strategy

How Hedge Fund Activists Influence Target Firms

Leadership & Organisations

A Checklist for Boards in the New Normal

Leadership & Organisations

Pandemic or No, It’s Business as Usual for Boards

Leadership & Organisations

Power, Politics and Crisis Response on the Board

Leadership & Organisations

Three CEO Strategies to Guide Companies Through Crises

Leadership & Organisations

Covid-Era CEOs Are ‘Keen, Tough or Edgy’

Leadership & Organisations

Seven Questions for Corporate Boards Navigating COVID-19

Leadership & Organisations

The Role of the Board in Times of Distress

Operations

A Crisis Management Blueprint for COVID-19

Strategy

Maximising Outcomes in Impact Investing

Leadership & Organisations

Putting More Women at the Helm of Corporate Boards

Leadership & Organisations

A Corporate Governance Paradigm Shift

Responsibility

From Good Intentions to Maximising Your Impact

Operations

Preparing Your Firm for AI

Responsibility

A New Framework for Corporate Activism

Strategy

Boards Under the Influence

Economics & Finance

BRT: A New View of Corporations and Capitalism

Economics & Finance

BRT: The Fuzzy Purpose of the Corporation

Economics & Finance

BRT: The New Capitalism?

Leadership & Organisations

The Icarus Syndrome: Execs Who Fly Too Close to the Sun

Economics & Finance

How Charities Should Manage Their Cash

Responsibility

Sustainability and the Five Archetypes of Boardroom Behaviour

Leadership & Organisations

Women Chairs: The Time Is Now

Strategy

Responding to the New Cold War

Responsibility

What’s Stopping Boards from Taking Action on Sustainability?

Leadership & Organisations

How Shifts in Geopolitical Power Will Affect Corporate Governance

Leadership & Organisations

For the Truth About How Bosses Behave, Ask Their Assistants

Economics & Finance

Finance as a Force for Good

Leadership & Organisations

How the Board Can Make the Most of Blockchain

Leadership & Organisations

Agile Boards of Directors: A Fad or the Future?

Career

Lessons for Boardroom Debutantes

Leadership & Organisations

The Key to Cultivating Agility in Decision Making

Leadership & Organisations

The Best CEOs Are Ready for Crises

Leadership & Organisations

CEOs Should Be Chief Enablement Officers

Economics & Finance

Giving Workers Equal Representation on the Board

Leadership & Organisations

How Leading CEOs Nominate Their Top People

Career

Ten Networking Strategies to a Seat on the Board

Leadership & Organisations

The Four Essential Roles of a CEO

Strategy

Governance Needed for Initial Coin Offerings

Leadership & Organisations

Tailored Approaches Needed for Gender Balance

Leadership & Organisations

The Slow and Steady Progress Towards Gender-Balanced Boards

Responsibility

Big Investors Call for Company Attention to Social Purpose: What Next?

Family Business

Why Family Firms Lack Analyst Coverage

Strategy

Leapfrog Into an Innovative Future

Leadership & Organisations

Do CEOs Deserve Their Pay?

Leadership & Organisations

Five Practices of the Most Change-Ready Leaders

Leadership & Organisations

Turbulent Times Call for Athletic Leaders

Strategy

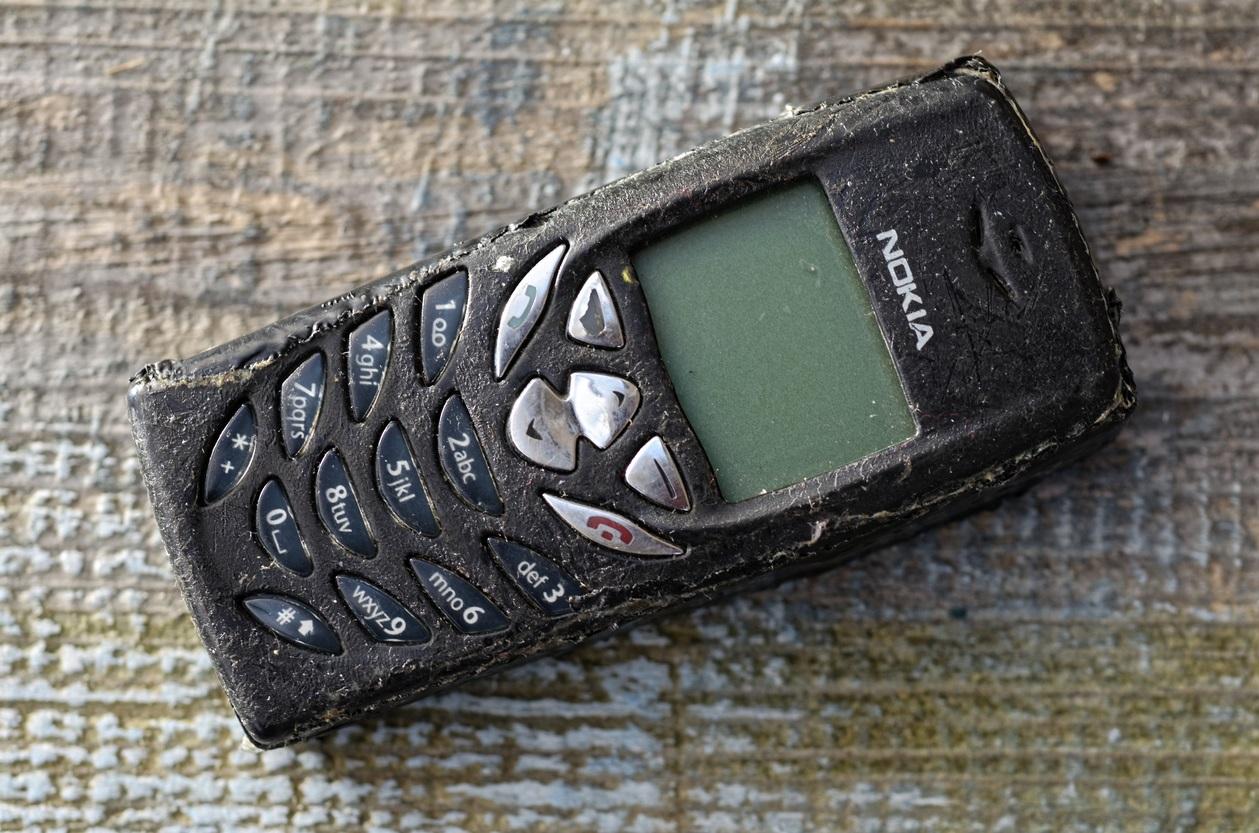

The Strategic Decisions That Caused Nokia’s Failure

Leadership & Organisations

Corporate Culture Is an Alarmingly Low Priority for Boards

Leadership & Organisations

How Boards Will Look in Ten Years

Leadership & Organisations

The Practices of Boards Across the World

Leadership & Organisations

The 3 Es of Effective Board Leadership

Operations

Cybersecurity: The Role of the Board

Leadership & Organisations

12 Questions to Determine Board Effectiveness

Family Business

Five Challenges That Could Derail a Succession Plan

Family Business

Four Simple Rules for Succession Planning

Economics & Finance

The Economic Consequences of Shareholder Value Maximisation

Leadership & Organisations

11 Leadership Guidelines for the Digital Age

Leadership & Organisations

Intelligent Boards Know Their Limits

Responsibility

Should the Unilever Model of Capitalism Be Protected?

Economics & Finance

Anti-Takeover Provisions Backfire

Strategy

Three Ways to Get Ahead of the Digital Competition

Economics & Finance

Why You Should Give Investors Greater Say on CEO Pay

Strategy

A Framework for Driving Digital Transformation

Leadership & Organisations

Why the Whole Board Needs to be on Top of Risk Management

Economics & Finance

The EU Cannot Be at the Mercy of the Few

Leadership & Organisations

The Value Lurking in Your “Leadership Unconscious”

Leadership & Organisations

Lessons in Destructive Leadership from Africa

Strategy

Three Steps to Creating a Diverse Organisation

Leadership & Organisations

Board Political Leanings Determine CEO Pay

Strategy

Leaders in Digital Merge the Physical and the Virtual

Economics & Finance

Gender Diverse Boards May Have Less Inside Information

Economics & Finance

The Mixed Results of Motivational Rankings

Leadership & Organisations

“INVOLVE” – A Toolkit For Fair Process Communication

Strategy

Are You Next for Digital Disruption?

Leadership & Organisations

Ambiguous Leadership Undermines Compliance

Leadership & Organisations

How to Stop CEO Failure

Operations

Making Digital Work For You

Marketing

Do Happy Customers Lead to Happy Shareholders?

Strategy

What Corporate Strategists Need to Know About Synergies

Operations

Holding PE to its Word – A True Measure of Value Creation

Family Business

Dangers of Gun-based Succession Planning

Strategy

The Mindset Needed For Digital Change

Leadership & Organisations

Getting Boards into Reputation Risk Management

Leadership & Organisations

The Face Behind the Chair

Strategy

How to Institutionalise Innovation

Operations

The "Internet of Things" at Risk

Operations

The End of Human Risk Management?

Leadership & Organisations

Are You Sure You Want to Join a Board?

Leadership & Organisations

Creating Boards for the Future

Leadership & Organisations

Managing Godfathers

Responsibility

VW: What Happened and What Happens Next?

Responsibility

Volkswagen: Requiem for a Dream?

Leadership & Organisations

The Mindset of Internationally Successful Companies

Strategy

Eight Ways the Military Manages Uncertainty

Leadership & Organisations

How to Stay in Business Through a Disaster

Economics & Finance

Who’s Afraid of BlackRock?

Leadership & Organisations

What Business Leaders Can Learn from Generals

Responsibility

How Not to Respond to a Scandal

Responsibility

New Tools Needed for Managing Uncertainty

Leadership & Organisations

Bridging the Trust Chasm

Career

Why Firms Need “Outduction” Programmes

Leadership & Organisations

The Support-Challenge Tightrope in Board-CEO Interactions

Leadership & Organisations

The Medical Risks of Increasing Business Travel

Leadership & Organisations

The Cause and Effect of Better Decision-Making

Leadership & Organisations

Protect Rogue Thinkers

Leadership & Organisations

Sustainability: From the Back Room to the Board Room

Family Business