Karel Cool

Professor of Strategic Management

Biography

Karel Cool is a Professor of Strategy and the BP Chaired Professor of European Competitiveness at INSEAD. His competitive strategy research, teaching, and consulting focus on questions of industry dynamics and competitive positioning (e.g., assessment of profit opportunities in markets; constructing competitive advantage, supply chain dynamics and management; achieving eco-system leadership; vertical integration and de-integration; industry overcapacity; achieving critical mass in platforms and innovation ecosystems; the creation of standalone and network customer value). Karel Cool is directing the Competitive Strategy Executive Education programme. His research and teaching has focused in recent years on Sustainability as a Business Opportunity and is co-directing the new INSEAD Business Sustainability Programme.

He has published in many journals, including Management Science, Strategic Management Journal, Harvard Business Review, Organization Science, Academy of Management Journal, Marketing Letters, Advances in Strategic Management, Journal of Supply Chain Management, etc.; co-edited books such as European Industrial Restructuring in the 1990s and Industry Structuring and Restructuring; and has contributed to many books on competitive strategy.

From 1995 to 2007 he was an Associate Editor of the Strategic Management Journal, a leading strategy journal.

He has consulted on major strategic issues of corporate and industry restructuring, and worked with various corporations including Unilever, PriceWaterhouseCoopers, Daimler, Borealis, RollsRoyce, Exxon, Solvay, Novo-Nordisk Lufthansa, KBC, Whirlpool, IBM, Expedia, Banque de France, McKinsey, Starwood, BCG, Shell, ING, Aktiva, Amgen, Bayer, Nordea, World Economic Forum, KGL Kuwait, Hearst, Reynaers Aluminium, Ørsted / Dong Energy Wind Power, Vandemoortele, Mars, Illumina, Danfoss, Pictet, etc.

During the 1995-1996 academic year, he was a Visiting Professor at the Graduate School of Business at the University of Chicago. He was also for many years Visiting Professor at Northwestern University (Kellogg), and was co-chair of the 2002 Strategic Management Society Conference (Paris).

He is a seven-times winner of the Best Teaching Award in the MBA programme. In 2007 he was inducted as a Fellow of the Strategic Management Society and in 2009 received the George S. Day Distinguished Alumni Academic Service Award from Purdue University.

In September 2014, he was honoured by the Case Center as one of the best-selling case authors over the past forty years — Karel has (co-)authored more than eighty case studies.

Karel Cool obtained his PhD (1985) and MScIA (1982) from Purdue University, and his MA (1981) and Lic (1978) in Applied Economics from the University of Antwerp (UFSIA).

He has published in many journals, including Management Science, Strategic Management Journal, Harvard Business Review, Organization Science, Academy of Management Journal, Marketing Letters, Advances in Strategic Management, Journal of Supply Chain Management, etc.; co-edited books such as European Industrial Restructuring in the 1990s and Industry Structuring and Restructuring; and has contributed to many books on competitive strategy.

From 1995 to 2007 he was an Associate Editor of the Strategic Management Journal, a leading strategy journal.

He has consulted on major strategic issues of corporate and industry restructuring, and worked with various corporations including Unilever, PriceWaterhouseCoopers, Daimler, Borealis, RollsRoyce, Exxon, Solvay, Novo-Nordisk Lufthansa, KBC, Whirlpool, IBM, Expedia, Banque de France, McKinsey, Starwood, BCG, Shell, ING, Aktiva, Amgen, Bayer, Nordea, World Economic Forum, KGL Kuwait, Hearst, Reynaers Aluminium, Ørsted / Dong Energy Wind Power, Vandemoortele, Mars, Illumina, Danfoss, Pictet, etc.

During the 1995-1996 academic year, he was a Visiting Professor at the Graduate School of Business at the University of Chicago. He was also for many years Visiting Professor at Northwestern University (Kellogg), and was co-chair of the 2002 Strategic Management Society Conference (Paris).

He is a seven-times winner of the Best Teaching Award in the MBA programme. In 2007 he was inducted as a Fellow of the Strategic Management Society and in 2009 received the George S. Day Distinguished Alumni Academic Service Award from Purdue University.

In September 2014, he was honoured by the Case Center as one of the best-selling case authors over the past forty years — Karel has (co-)authored more than eighty case studies.

Karel Cool obtained his PhD (1985) and MScIA (1982) from Purdue University, and his MA (1981) and Lic (1978) in Applied Economics from the University of Antwerp (UFSIA).

Latest posts

ZhongAn’s Micropremium Model: The Future of Insurance?

K. Cool, C. Angoulvant, B. Rogers

With scale, Chinese online insurer ZhongAn has created a market where there was none before.

Disrupting the Car Insurance Industry

B. Rogers, K. Cool, C. Angoulvant

The London-based start-up Cuvva competes with incumbents by making it easy for drivers to buy pay-as-you-go insurance.

2

comments

Insurtech Is Hitting Critical Mass

C. Angoulvant, K.Cool, B. Rogers

The wisest insurance incumbents will seize the collaborative opportunities springing from this new environment.

1

comment

Pirelli’s Acquisition by ChemChina: Has a New Era Begun for the Global Tyre Industry?

Consolidation speeds up in the global tyre industry as Pirelli gains rare access to the Chinese market ahead of Western peers.

3

comments

Could IBM Become the Nokia of Supercomputers?

Supercomputing is being squeezed by new cloud computing competitors and more expensive component suppliers. How will the likes of IBM adapt to this hostile environment?

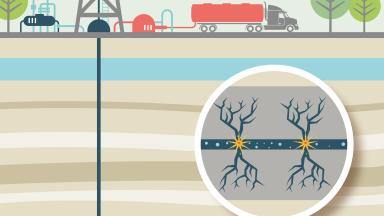

Is Europe Stuck in a Vicious Energy Cycle?

The shale gas boom in the United States has made domestic power producers cleaner and turned coal producers into major exporters. A weak Europe, anxious about fracking, is becoming reliant on cheap U.S. coal to fuel its power stations, trapping it in a vicious cycle.

2

comments

Shale Gas: Hype or Hope?

A two-thirds plunge in U.S. natural gas prices thanks to soaring output of shale gas has given a boost to U.S. industry that is now being felt in the rest of the world. The impact in terms of competition threatens to be particularly strong in Europe, where high labour and energy costs are discouraging investment and driving companies elsewhere.

3

comments

Europe’s shale gas competitiveness challenge and consequences for the petrochemical sector

“I think it’s simply irresponsible to declare that we don’t need [shale gas] and we don’t want [shale gas] here in Europe”. Kurt Bock, CEO of BASF[ii]

The Competitiveness Challenge of European Manufacturers: The Case of Michelin

Michelin has done it all. It was the innovator of the radial tire, which the world is still driving on today; Michelin’s tires are very frequently voted the best tires by authoritative consumer surveys around the world; its Bidendum man brings smiles to young and old and is one of the best known brands around the world; Michelin was the single supplier of tires to the Space Shuttle during the entire life of the space program; and Chefs in restaurants around the world aspire to get a star from the same Michelin company. Michelin has set the standard for several decades.

Merger Control and Practice in the BRIC Countries vs. the EU and the US: The Timing

Karel Cool

By Philippe Ombregt, Karel Cool, Nicolas Harlé

Mergers or acquisitions are often the preferred way to enter rapidly growing geographies such as the BRIC countries. Also, domestic companies in these geographies frequently use M&A’s to challenge foreign entrants or to become a player with global ambitions. Without surprise, the number of M&A’s in the BRIC countries exploded during the last decade. We documented in a first article “Merger control and practice in the BRIC countries vs. the EU and the US: The facts”, that the number of M&A’s in the BRIC countries increased more than twenty-fold between 2001 and 2011, from 346 to 7654. This is equivalent to about half the number of M&A’s in the EU or the US in 2011; it stood at roughly a twentieth in 2001.

Merger Control and Practice in the BRIC Countries vs. the EU and the US: Review Thresholds

Karel Cool

Written by Nicolas Harlé, Philippe Ombregt and Karel Cool

With more than 90% of global GDP growth coming from the rapidly developing economies,[2] companies from around the world are targeting these markets for future expansion. The BRIC (Brazil-Russia-India-China) cluster has been a major magnet as it represents about 25% of global GDP and over 60% of global growth.

Carrefour: the new Kmart?

Karel Cool

The newly appointed CEO of Carrefour, M. Georges Plassat, has given himself three years to rebalance the Carrefour Group. Describing Carrefour as a “duck without a head”[i] – and thus no vision –, he is certainly aware of the challenge he is up to. The fall from grace of Kmart of the US is a frightening reminder of the potential urgency of Carrefour’s refashioning.