The creation of deep tech ventures, fuelled by hard science, is notably different from the development of digital innovations.

Deep tech ventures encounter layers of challenges in the commercialisation process. This is due to factors like fundamental performance limits, development time to market, funding intricacies, customer concentration, prototyping and various other considerations. However, these same factors also thin out the competition.

Unlike digital innovations, where app stores simplify the process, deep tech ventures need to carefully consider their position in the industry's value chain before investing significant time and money in developing a prototype or product.

However, entrepreneurs should only focus on value chain placement once they have a solid understanding of the core science underlying their innovation and have identified compelling use cases. This process is outlined in The Deep Tech Playbook, a manual I put together for entrepreneurs moving hard science innovations from the lab to market.

In the playbook, I present two different approaches to finding your place in the industry value chain. The first involves controlling the placement decision yourself, while the second leans towards aligning with customer and market demands, even if it diverges from the optimal return on investment (ROI).

1. Optimising the return on productisation investment

A straightforward ROI analysis will determine your optimum placement in the value chain based on a comparison of the discounted cash flows from each product form and the investment capital required to support these cash flows over time. While IP licensing may generate less cash flow, it demands significantly lower capital, potentially resulting in a higher ROI.

2. Optimising on customer and market need

For your customers, the preferred product option might differ from the one maximising your ROI. The end users might feel uneasy purchasing a complete system from a start-up, questioning its long-term sustainability. They may prefer that you supply components or subsystems to an established and trusted full system manufacturer, which then assembles, sells and services the final product.

In another scenario that challenges ROI optimisation, you may be required to develop control algorithms or evaluation kits for customer testing of assemblies or systems pre-orders, even though these are expenses that won’t be recovered.

From a financial standpoint, the preference often leans towards the first option. Yet practical considerations tend to steer entrepreneurs towards the second option due to market dynamics and customer expectations.

Prophesee, a French developer of advanced vision technologies, provides a good example. Based on an ROI analysis, it originally planned to license hardware vision sensors directly to end-of-value-chain original equipment manufacturers (OEMs) like BMW or Honeywell. But these large industrial manufacturers were reluctant to source critical components directly from a start-up. So Prophesee pivoted to selling hardware indirectly through foundry partners and established camera suppliers, while licensing only the chip reference design software directly to the OEMs. It also developed camera system test kits to help derisk the technology for its customers (and their customers). These kits, on their own, generate no ROI.

Understand your market dynamics and their impact on design

Market timing is another critical consideration. To accelerate the adoption of your innovation, you may have to move up the value chain. No one will be eager to license your IP or source your component if there isn’t a clear and established path to adoption in the existing industry.

Consider a scenario where you have novel 3D actuated MEMS mirror IP optimised for optical communication networks, but no one in the industry has yet developed a full optical switching system. You can wait for an established systems manufacturer to develop one and become its MEMS mirror supplier, or, if you have sufficient resources, you could design and construct the entire system yourself. While the latter option is expensive, it may be the quickest route to market, thereby affecting your ROI analysis.

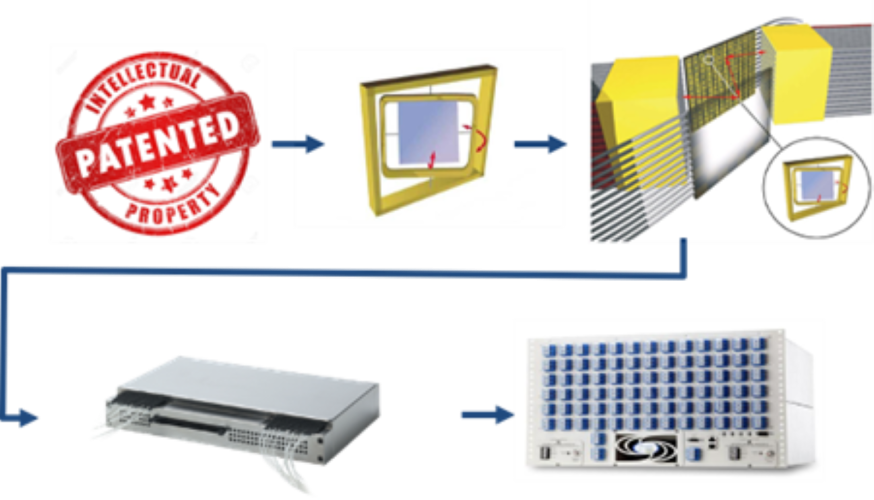

An optical switch value chain: IP, component, module, subsystem and full system.

If you have the option to bring your innovation to market at various points along the value chain, it is advisable to conduct an ROI analysis. Even a simple calculation based on imperfect information should be undertaken. Ultimately, however, a successful market placement will likely be dictated by the existing industry supply chain structure and your customers’ expectations. How can you discern your customers' expectations? Ask them.

Before investing significant resources in prototypes, it is important to first understand how you intend to productise your scientific innovation (based on an ROI estimate) and how the market prefers you do so (based on validation discussions with key stakeholders). In a beautiful world, these preferences align harmoniously.

Always seek feedback and prepare to pivot

Next, it is time to identify your most attractive customer targets by industry, company and title. There might be 100 target individuals, or there may be 10 or fewer. Who can you contact to introduce your innovation and confirm your assumptions and preferences on how its value can be best leveraged in the market?

Consistent with the core tenets of the Lean Startup methodology, it’s critical to validate your assumptions on how and where your innovation will find its place in the market before committing considerable resources to that commercialisation effort.

Sketch the value chain – from core IP to end retail sale – of each product market you plan to enter. Your insertion points along each chain will likely be bounded by a pure IP licensing option at one end and a complete system/platform productisation at the other.

Considering an ROI analysis and other resource-related factors such as limiting constraints or enabling assets, where would you prefer to position your innovation within the value chain? With whom can you discuss your innovation and share your commercialisation model assumptions, as they stand at this early stage, for feedback?

This may involve engaging with those directly preceding you on the chain (your suppliers) and those further ahead (your customers). These discussions will either confirm or refute whether they understand and value your deep tech disruption, and if they would, in theory, be interested in supplying to or sourcing from your organisation.

Additionally, determine the considerations and requirements, beyond price, that would influence their decisions to be suppliers or customers. These could be technical or financial. Feedback from these early discussions will allow you to reevaluate your position in the industry value chain.

Analysing the value chain placement for your compelling use cases will assist you in ranking them based on ROI, time to market and the challenges associated with commercialisation. The next step, as outlined in the Deep Tech Playbook, is to select the single most attractive use case by weighing these factors, and then take a deeper dive into design and features optimisation.

Edited by:

Katy ScottAbout the research

-

View Comments

-

Leave a Comment

No comments yet.