The concept of the circular economy, most recently popularised by the Ellen MacArthur Foundation, was first raised by David Pearce and Kerry Turner, two British environmental economists. They pointed out in their book, Economics of Natural Resources and the Environment, that the open-ended economy had no built-in tendency to recycle and effectively treated the environment as a waste “reservoir”. The “take, make, dispose” economic model, explains the Ellen MacArthur Foundation, is reaching its limits.

Advocates of the circular economy model, such as the foundation, recommend rethinking the way products are designed so that they can be “made to be made again”, turning the conveyor belt of consumerism into a circle (a closed-loop supply chain). The ultimate aim is to eliminate waste, an especially welcome goal as consumerism continues to increase and raw materials continue to run out.

But we believe there are some crucial considerations that have been overlooked, which could jeopardise the circular economy model. To achieve widespread adoption, companies need a solid business case, in addition to the environmental benefits they can achieve. For a successful transition, companies will also need external supports, such as financing models, appropriate legislation, a change in consumer behaviour and new business models. Without the right context, they may try and fail, which could cause disillusionment with the idea, and potential sustainability champions will drop out of the running.

Consumer behaviour

In our recent research, we find that an integrated perspective is needed on the sub-processes of the closed-loop supply chain to assess the profitability of remanufacturing.

The first major hurdle is consumer behaviour. Several studies have shown that consumers are not likely to pay more for remanufactured products, which means companies engaging in remanufacturing have to keep costs of recovery and reproduction below original manufacturing costs. This is no small feat, given the additional logistics involved, such as product collection, disassembly, repair/remanufacturing, resale and delivery.

But the closer to consumer products a manufacturer is, the more it is at the mercy of its customers’ behaviour. Take a child stroller manufacturer we know of, which piloted a leasing model for new strollers so customers could choose to rent instead of buying a new one. The plan was to remanufacture them after leasing in order to lease them again. The initial pilot revealed challenges in tracking, tracing and regulatory compliance of refurbished products, which led to questions over financial feasibility. Some strollers were returned in bad condition or were not returned at all. This left the company carrying the can. For this and other commercial reasons, the leasing plan was halted and postponed. Our analytical model had predicted this even if only a small percentage of consumers misbehaved, but the company did not believe this would happen. They learnt a lot with the pilot, especially that many contextual conditions beyond their control need to be satisfied for a circular model to be profitable, not the least of these being proper consumer behaviour.

Is remanufacturing always better?

This uncertain condition of the returned product means companies lose visibility on their potential profitability. Given that they will not know what kind of state a returned product is in until they receive it back from the customer means they will need the capability to examine the product's feasibility for remanufacture. Some parts may be perfectly reusable, others may require more assessments or repair, draining time and resources. This adds layers to the process, such as inspection and testing followed by assembly of the approved parts.

Aside from the additional cost and resources necessary in a closed-loop model, there is not always a good indication of improved environmental benefit. Electronic products have an optimal lifespan and in the case of some products, technological advances in new iterations could improve efficiency, meaning that it may be environmentally wiser to replace them with new ones. New components may also need to be part of the remanufacturing phase. This requires modular product designs in which some modules can be replaced in order to upgrade them. But this tends to be more expensive.

A tool for companies

An objective analysis is therefore necessary. Companies need to know whether it is likely to work for them or not. In our paper, “Assessing the economic and environmental impact of remanufacturing: A decision support tool for OEM suppliers”, we propose a tool that manufacturers can use to quickly assess whether remanufacturing is both economic and environmentally attractive, compared to producing new products.

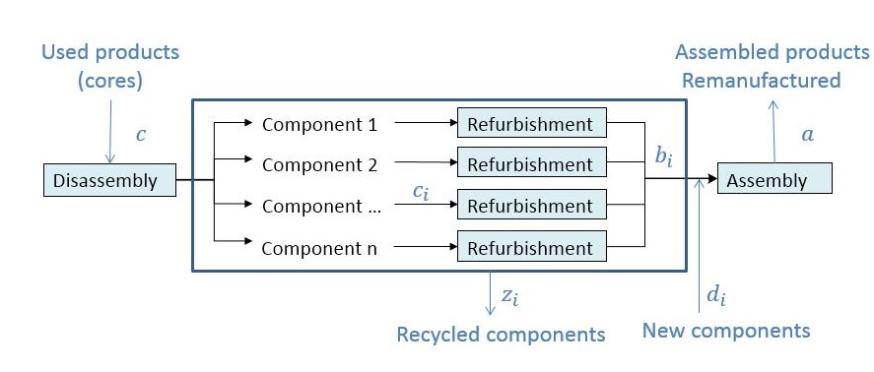

The model we propose uses 17 variables describing the main cost components and some operational parameters such as “remanufacturing yield”. This allows companies to get an idea of the economic feasibility of remanufacturing, before they spend a large amount of money and resources in trying to design a new business model which might not work. The model calculates the optimal amount of new versus refurbished components that will be assembled in the remanufactured product. Since a certain percentage of the used components cannot be remanufactured due to low quality, a larger number of used products are needed to have enough reusable (successfully refurbished) components. The exact amount of components that are needed for the refurbishment process can differ per component type, i.e. different component types can have different remanufacturing yield rates. The number of used products to be acquired is a decision variable to minimise the total remanufacturing costs.

The remanufacturing process

Each step in the remanufacturing process has direct costs associated with it. By calculating the number of products / components going through each step (based on the optimisation), the total costs of remanufacturing can be established and compared with that of manufacturing new products. If acquiring used products, disassembling them and refurbishing the components is more expensive than using only new components, the tool will provide the optimal solution to produce remanufactured products with only new components, suggesting that remanufacturing is not a feasible strategy for the company.

A tool for the environment

The model also takes the environment into consideration. Hypothetically, products can be remanufactured a number of times, cutting out the need for new raw materials. But in reality, the number of times a product can be remanufactured is limited.

For each activity, there will be environmental impacts, such as the CO2 value of raw materials, assembly and transport to the supplier and then transport of the finished product to the end customer. Similarly, return transport, remanufacturing and forward transport lead to additional CO2. At the end of its life, the remanufactured product is recycled or discarded. By calculating the carbon footprint over the whole product lifecycle, the environmental impact of remanufacturing can be compared to the situation where only new products are supplied.

Using this model, the company can assess its potential profitability as well as compare the environmental impact with that of making a new product.

The model in practice

To illustrate how this model can work in practice, we analyse a chassis products manufacturer which does remanufacturing for original equipment manufacturers (OEMs). It is considering expanding the market for remanufactured steering gears. This involves buying “dirty cores” and selling remanufactured gears from and to third parties.

Each core contains multiple components, some of which may be reusable and others not suitable for remanufacturing. The company determined that it minimises costs if it acquires 1.67 dirty cores for every remanufactured product. Even in this case, however, it will still need to buy some new parts. The cost to acquire, disassemble and refurbish a core to reuse only a part is more expensive than manufacturing new components.

Ideally, the company needs to keep the acquisition price of used products below €30 if remanufacturing is to be attractive. If the “remanufacturing yield” is improved, a higher price could be feasible. In this company’s case, it was found that the costs of remanufacturing were higher than producing new gears, even if cores could be sourced at the lowest market price. The value saved by reusing old gears was not sufficient to outweigh the higher costs of acquisition of used gears and the more extensive manual labor required in the remanufacturing process.

We also tested whether an optimised production design could lower the cost of disassembly, refurbishment and assembly. Such optimised design normally results in higher costs, which can be earned back once the company remanufactures the product. But if only a small quantity of total production volume can be remanufactured, which was the case here, it leads to higher overall costs.

On the environmental side, production of new gears results in 11kg of CO2 per item, while the remanufacturing operations add 3kg of CO2. Assuming that all products are returned for remanufacturing once, the average CO2 per steering gear is 8kg. This is a positive environmental impact, but such environmental benefits alone are not enough to motivate companies to adopt circular business models.

Is your company ready?

Although this analysis focuses on a very specific case in one particular industry, our model and results are applicable to a wide range of organisations. Companies must evaluate the costs and resources associated with acquisition of used products, disassembly, inspections, refurbishment, reassembly and distribution of remanufactured products. They may well need new components to complement those being refurbished, which adds to costs. Ultimately, the exercise needs to be profitable if it is to be both economically and environmentally sustainable.

While the prospect of the circular economy is attractive from a macro-economic perspective, on a micro-economic level individual companies may experience serious hurdles. Not only new business models and modular products are required, but also a favourable legal context, financial support and changing consumer behaviours. Companies are well-advised to perform an in-depth analysis before jumping on the circular economy bandwagon, and simple analytical models like the ones described in our paper can help to evaluate many different scenarios.

Luk Van Wassenhove is Professor of Technology and Operations Management and the Henry Ford Chaired Professor of Manufacturing at INSEAD and a co-editor of Managing Closed-Loop Supply Chains. He is also faculty lead for the INSEAD Humanitarian Research Group.

Patricia van Loon is a Postdoctoral Research Fellow at INSEAD.

-

View Comments

(1)

-

Leave a Comment

Anonymous User

28/08/2017, 08.55 pm

THX .. reading ... teasing ... tempting ... then nothing ... ;-) HELP