In the current era of disruption, recently accelerated by the pandemic, firms must be in command of cutting-edge technologies; otherwise, they face potentially mortal danger. That is why I counsel corporate leaders to imagine how an agile, digital start-up could completely destroy their business, and to formulate defensive strategies to pre-empt such an attack. My co-authors Ian C. Woodward, V. “Paddy” Padmanabhan, Ram Charan and I provide detailed advice on how to design such wargaming sessions in our new book The Phoenix Encounter Method. One of our book’s key takeaways is that success in this new era requires a holistic approach to technology.

Too often, leaders only pay attention to the technological changes at the core of their business and ignore those seemingly on the periphery. Yet far-flung innovations can be more impactful than proximate ones. For example, the introduction of the smartphone was not initially seen as a game-changer for the taxi industry. But by making ride-hailing apps like Uber, Grab and Gojek possible, Android and iOS devices helped trigger the turmoil that industry is now enduring. And even as these apps were disrupting the taxi industry, automakers were mistakenly ignoring them as a potential threat to their business. To avoid being blindsided, leaders must proactively scan the landscape of emerging technologies and strategically leverage innovation to transform how their company does business. In other words, they must shift their mindset from product-focused innovation to process-focused innovation or, as it is better known, business model innovation (BMI).

Very often, innovative business models are not new. Keep in mind that Uber invented exactly none of the essential elements of its business model, whether strategic (gig-economy approaches to mobilising freelancers on an ad hoc basis existed before Uber, e.g. call-centre companies such as Liveops), technological (smartphones, GPS, etc.) or operational (e.g. dynamic pricing). However, Uber was the first to bring these elements together in the precise configuration necessary to square the circle of supply and demand in the taxi industry. Uber’s smartphone-summoned army of drivers piloting their own vehicles provides an unbeatably high ratio of market-responsiveness to demand uncertainty. A conventional taxi company that has to purchase and maintain its own fleet and pay drivers an hourly rate could never be as flexible. The power of technology and BMI lies in the ability to handle uncertainty better so as to create and capture value.

When leaders plan their own attempts at BMI, they should keep Uber in mind. Again, the goal is not to reinvent the wheel, but rather to leverage technology in devising new methods of handling uncertainty to benefit the business. The uncertainty or the corresponding risk in question could be your own, or that of your clients (in the case of B2B firms).

Let’s look at some examples of how this works in practice.

Resequencing business processes

One way to handle uncertainty (i.e. risk) better is to resequence business processes such that decisions are made when more information is available. Michael Dell created a business model wherein customers could customise their computers to a high degree (the potential number of SKUs being in the hundreds of millions) and catered to this demand with highly efficient processes. He accomplished this by modularising the computer (essentially making it a Lego-like product) and moving to an on-demand assembly process, building only those machines that customers had specifically selected and paid for.

The idea of resequencing has been used successfully in many other industries. Bag manufacturer Timbuk2 successfully created a Dell-like assembly-to-order system. Instead of guessing in advance what colours would be “in” for the upcoming season, Benetton delayed the dying process for its garments until it knew more about current trends. The airline and hotel industries followed the same principle by relying on dynamic pricing, i.e. postponing the pricing decision until more information about consumer demand was revealed.

Reducing clock-speed

Zara became the leading fashion company in the world by fundamentally changing the industry’s long-standing business model. Roughly speaking, the fashion business followed the sequence of design, manufacture, sell and liquidate. This sequence began nearly a year before the products involved were actually to be sold. Rather than focusing on product margin, Zara focused on speed and condensed the lead-time from design to placement on store shelves to a mere three or four weeks. This allowed Zara to dramatically reduce its demand uncertainty – it now only needs to forecast how many of each particular garment it will sell (over a much shorter span of time). Moreover, thanks to the short lead time, Zara can produce designs that are already trending with consumers.

3D printing is an emerging technology that promises to increase production speed for highly specified products. Its potential points towards a future of custom manufacturing that is as cost-effective as mass production, turbocharging on-demand manufacturing.

Transferring risks in the value chain

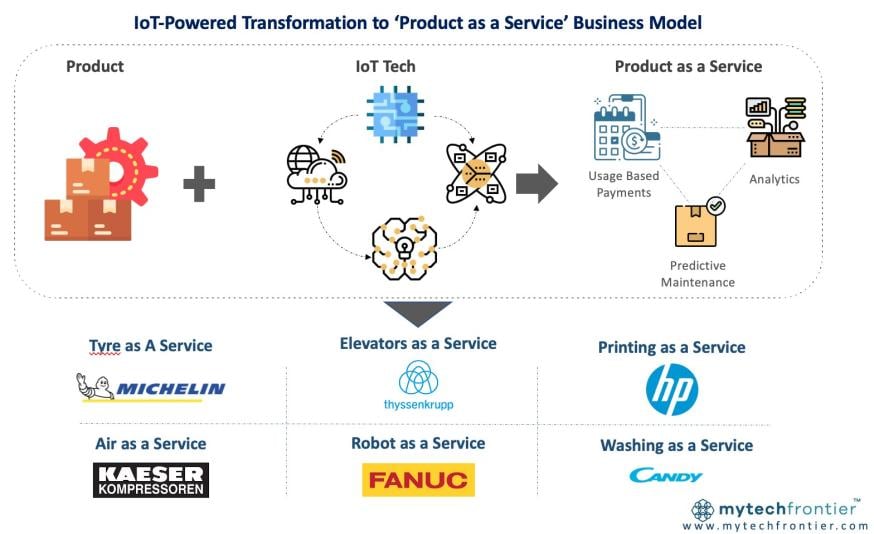

With the internet of things (IoT), many “pure sell” business models can be converted to pay-per-use, which may be a way of shifting risks from buyers to suppliers. And if the supplier is better able to absorb the risk due to lower costs of capital, it may create a win-win situation for both.

For example, tyre manufacturer Michelin is exploring product-as-a-service (PaaS) options for B2B clients (mainly commercial trucking companies) in some markets through its “Michelin solutions” arm. Instead of selling tyres as a stand-alone business, Michelin installs IoT-enabled trackers in each vehicle, which collect data on fuel usage, etc. The company can then offer clients advice on fuel-efficiency maximisation and other issues that may, in aggregate, unlock significant cost savings.

Similar models have been adopted by Thyssenkrupp (elevators-as-a-service), HP (printing-as-a-service) and FANUC (robotics-as-a-service). Across these examples, the basic idea is the same: Help clients reduce risk by charging them only for use, rather than complex, heavy equipment that may lie dormant during low-demand periods, or need extensive repairs in relatively short order.

Increased regulatory acceptance of blockchain technology may open new PaaS frontiers. Trusted peer-to-peer platforms for automating transactions would enable, for example, auto insurance to be sold on a per-route basis instead of through expensive lump sum payments.

Four steps to business model innovation

Once you have fully internalised a holistic approach to technology, you need an action plan for converting the resulting insights into concrete BMI. I recommend the following four steps.

- Measure risks across the entire value chain. Ask yourself: Are the risks real or artificial? How critical are the various risks? Which risks have the greatest potential for payoff if they were managed differently?

- Change risks. Decide how you want to reallocate your risk. Is your best bet changing relationships (e.g. Uber), resequencing business processes (e.g. Dell) or strategically speeding them up (e.g. Zara)?

- Experiment. This is the step many firms skip, to their peril. Only rigorous testing will confirm whether your value-based hypotheses were correct.

- After carefully carrying out the first three steps, roll out innovation.

-

View Comments

-

Leave a Comment

No comments yet.