Buybacks are under attack. In the first place, from left-wing United States politicians such as Elizabeth Warren who is co-sponsoring legislation aimed at curbing buybacks. The argument is that companies should use excess cash to increase salaries and create jobs, leaving out the fact that both measures are contradictory. But buybacks are also criticised by non-socialists who see them as a short-term stock price manipulation scheme, allowing insiders to cash out at inflated stock prices. This manipulation hypothesis predicts that, as a result of buybacks, companies will underinvest, undermining long-term performance and shareholder value.

In “Are buybacks good for long-term shareholder value? Evidence from buybacks around the world”, Urs Peyer (INSEAD), Alberto Manconi (Bocconi University) and I test this manipulation hypothesis using an international sample that contains approximately 10,000 buyback announcements made by U.S. firms and 10,000 made by non-U.S. firms in 30 other countries. These buyback announcements occurred between 1998 and 2010.

This is the first paper to examine a large global sample of buybacks. Most of the research on buybacks has been based on U.S. data, since share repurchases used to be illegal in many European countries before 2000. One reason for this reluctance has to do with a lack of commitment to shareholder value in many continental European firms. While buybacks are good for shareholders, they are not really an activity that maximises stakeholder value. Managers prefer to spend excess cash on acquisitions since CEO salaries are largely driven by firm size. Labour unions want the excess cash to be spent on higher salaries. As for bondholders, they don’t like the fact that a buyback increases leverage and therefore credit risk.

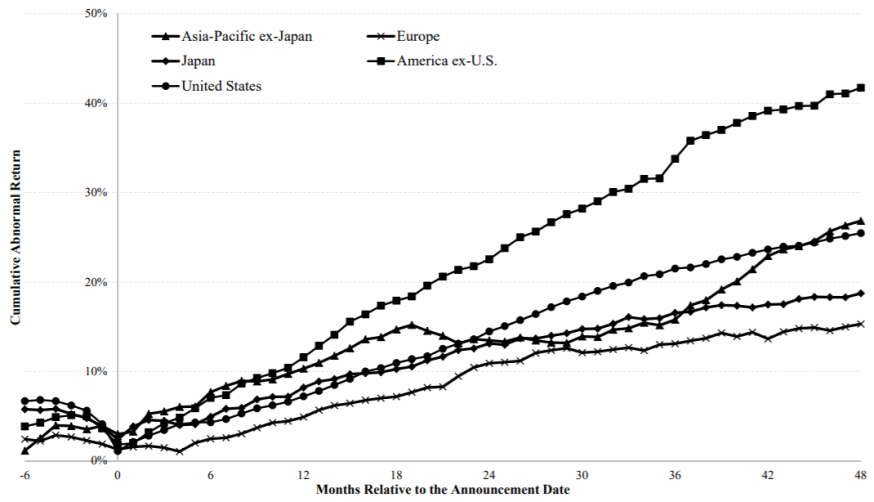

Recently published in the Journal of Financial and Quantitative Analysis, our results confirm those of studies based on U.S. buyback announcements. On average, a share repurchase programme by non-U.S. firms increases stock prices at the time of the announcement by approximately 2 percent. If this positive reaction would simply be a result of manipulation, the positive response would be reversed in the long run. The figure below shows that the opposite is true: It presents the cumulative abnormal (risk-adjusted) returns 48 months after the buyback announcements for five subsamples: U.S. firms, North-American firms ex-U.S. (mainly Canadian firms), Asian firms ex-Japan, Japanese firms and European firms.

The basic conclusion is that, on average, share buybacks are not a short-term manipulation scheme. They are good for long-term shareholder value in all regions: Cumulative abnormal returns are 24 percent for U.S. firms, 40 percent for non-U.S. North American firms, 25 percent for Asian firms (ex-Japan), 16 percent for Japanese firms, but only 14 percent for European firms.

The relatively poor results for Europe could be due to the fact that buybacks have to be approved by shareholders, not the board as in the U.S. So European buyback announcements are routine requests to authorise a buyback programme for the next 18 months, not signals of undervaluation. That’s why the European buyback announcements, in contrast to that in the U.S., are not preceded by significant negative excess returns during the previous six months.

Not all buybacks are equal though: The long-term positive excess returns are mainly due to buybacks made by small firms and value stocks that were beaten up during the six months prior to the buyback announcement. Indeed, while buybacks can be done for different reasons (capital structure management, EPS manipulation, tax savings), only in this subsection of firms are buybacks motivated by a desire to take advantage of undervaluation.

Theo Vermaelen is a Professor of Finance at INSEAD and the UBS Chair in Investment Banking, endowed in honour of Henry Grunfeld. He is the Programme Director of Advanced International Corporate Finance, an INSEAD Executive Education programme.

-

View Comments

-

Leave a Comment

No comments yet.